Financial processes are the backbone of every business. They are also some of the trickiest tasks to manage, especially if they are carried out manually. They consume a lot of time and are prone to errors, which puts a burden on the financial department.

Between managing balance books and drawing up the year-end closing, financial experts also have to manually check the financial data and ensure that all numbers add up. This process is not only tedious but also inefficient in the long run.

To simplify tasks and eliminate repetitive work, companies are turning to automation, specifically robotic process automation (RPA). If you’re unfamiliar with RPA or unsure about its benefits, don’t worry!

In this blog, you will learn what robotic process automation is, and how it can benefit financial departments and you’ll get real-life examples based on RPA use cases. Lastly, we’ll offer insights into a robotic process automation solution, so you too can automate financial tasks.

Let’s begin!

What is RPA in Finance?

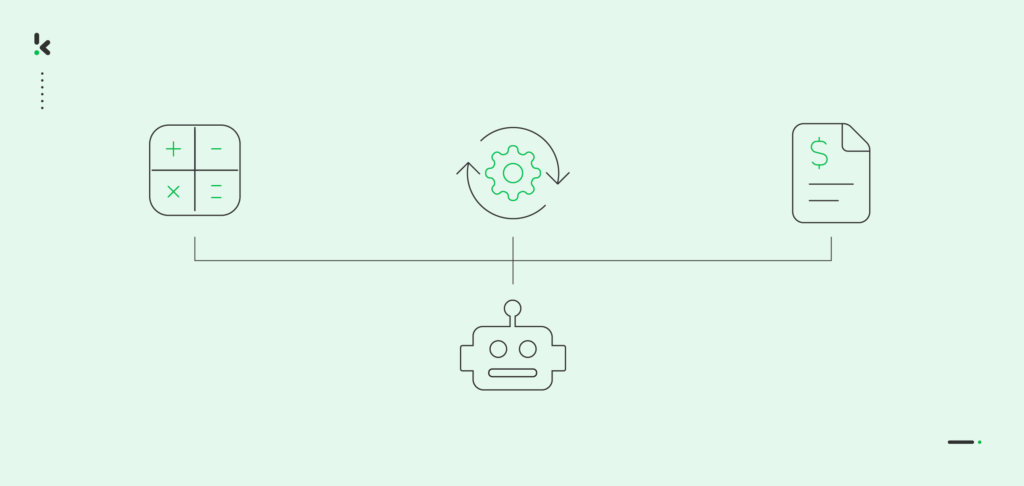

Robotic process automation (RPA), is a software technology designed to simplify complex workflows by automating repetitive tasks. It uses software bots and artificial intelligence to eliminate the need for manually completing financial tasks.

RPA in finance helps companies increase employee productivity and accuracy of data extraction. It does so by streamlining workflows and standardizing financial processes using modern technology. Instead of manually extracting data from receipts or invoices, businesses can leave these practices in the hands of robotic automation.

Take accrued expenses for instance. Often, businesses receive these payments later than expected. This delay affects the accuracy of the balance sheet and can even alter a company’s turnover. RPA can automatically register any upcoming payment, balancing the books in real-time.

In order to get the most out of RPA in finance, organizations have implemented this technology in many financial and accounting practices. Let’s look at some of the use cases of RPA in finance and see how automation can be an accountant’s best friend.

Use Cases for RPA in Finance

Robotic process automation in finance is a great asset to many organizations if used accordingly. Besides keeping track of the balance sheet and managing upcoming payments, RPA in finance can be a great tool to automate other financial processes as well, such as:

- Bookkeeping

- Invoice processing

- Accounts payable

- Expense management

- Purchase order processing

Bookkeeping

As you already might know, manual bookkeeping is a slow and tedious process. It is a task that requires you to double-check for manual errors, which can only slow down the process. RPA comes in handy and streamlines the accounting process altogether, allowing for robotic accounting.

Automating bookkeeping helps any organization, regardless of its size or workload. Growing companies that miss a dedicated finance department can easily complete their bookkeeping tasks by implementing RPA. The same process goes for large-scale companies with a great deal of financial documentation to process. The software accurately reads and extracts data from financial documents and updates the books in real-time.

Invoice Processing

As invoices come in many different formats, usually unstructured ones (e.g. PDF files), back-office employees have a hard time processing these documents. Automating invoice processing represents an improvement for both the suppliers and buyers.

RPA allows for invoice scanning, thus reducing the need for manually handling invoices and payment confirmations. All data is transferred into an accounting system, ensuring safer and faster transactions. The software also alerts users if there are any duplicates or false invoices, minimizing the risk of invoice fraud.

Accounts Payable

Implementing robotic process automation in the accounts payable process significantly improves financial reporting accuracy. The software helps automate the process of managing accounts payable, helping your AP department in increasing workflow efficiency, but also the speed of payment approval. Completing payments on time benefits both the buyers and suppliers, as it creates a relationship based on mutual trust.

Tasks such as data entry or payment approval are now automated using robotic process automation. RPA streamlines AP processes, for instance, the invoice-to-pay process, reducing manual errors and saving your organization precious time.

Expense Management

Processing expense claims or reimbursing travel expenses can be a time-consuming manual task within T&E management. Not only does it demand a significant amount of time and effort, but it also opens the door to potential errors or, even worse, document fraud.

Expense management using RPA involves automating approval workflows, expense accounts, and even expense reimbursements. With the help of robotic process automation, data from receipts, for example, is automatically extracted and transferred into the accounting system. This ensures a much faster and more secure reimbursement process, as only authorized users have payment approval authority.

Purchase Order Processing

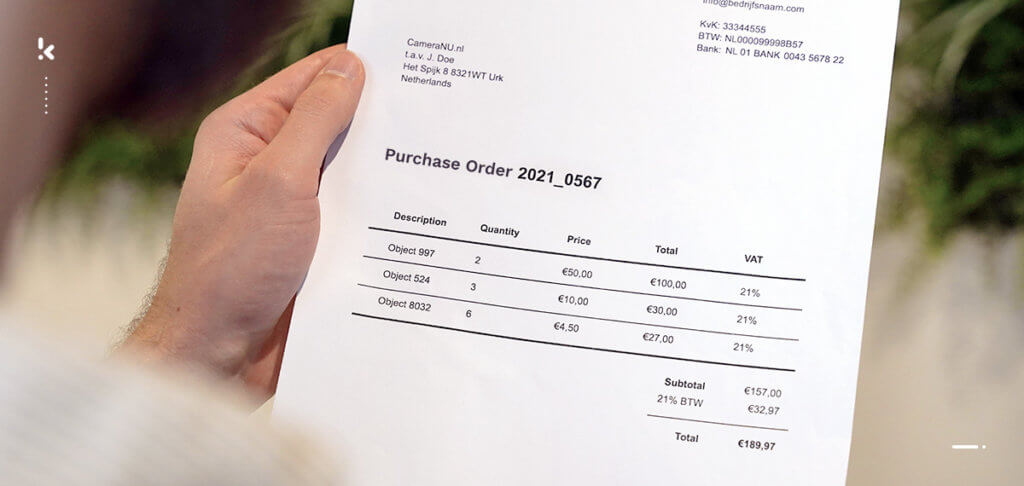

Purchase order processing, much like invoice processing, is a time-consuming task that often requires manual data entry. Purchase orders are sent to buyers in unstructured formats, which makes it difficult for them to process.

With RPA, you can scan the purchase order and extract data accurately. The data obtained from a PO is automatically entered into the software and transferred to your accounting system.

RPA for purchase order processing also includes diminishing the risks of fraudulent activities, such as vendor fraud, to occur. Robotic process automation is able to check for any mismatches or discrepancies between purchase orders and invoices, by performing two-way matching, therefore improving the relationship between buyers and vendors.

Even if you’re processing an invoice or drawing up the month-end close, robotic process automation in finance is a great asset. That’s why implementing robotic process automation in financial services can benefit you a great deal. Curious about what these benefits are? Keep reading and let’s see some of the advantages of using RPA in finance.

Benefits of RPA in Finance

Robotic process automation can help automate even the most detailed and dreadful financial tasks. Leaving manual data entry behind and embracing RPA comes with multiple benefits, namely:

- It is cost-effective: Businesses can save up to 30% of their budget by automating financial processes.

- It reduces processing time: Implementing robotic process automation in financial tasks can reduce up to 90% of processing time, allowing employees to focus on more value-adding activities.

- It minimizes errors: RPA helps streamline financial tasks, reducing human errors in the process and improving output quality.

- It increases workflow efficiency: With RPA, the accuracy of data extraction increases, eliminating the need for manual verification. This way, business operations can go on smoothly, improving workflow efficiency.

Finance robotic process automation is a great addition if you are looking to improve business operations or save large amounts of capital. However, its implementation can take up a lot of time, and as you might already know, time is money.

Instead of venturing into a whole process of allocating time and resources to set up robotic process automation from scratch, you might want to look into out-of-the-box solutions, such as Klippa DocHorizon.

The Best Alternative to RPA in Finance

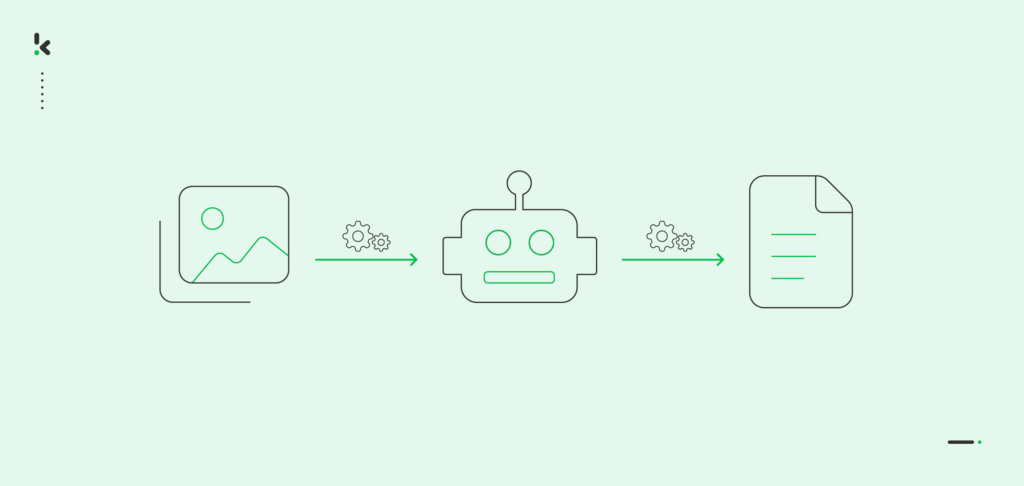

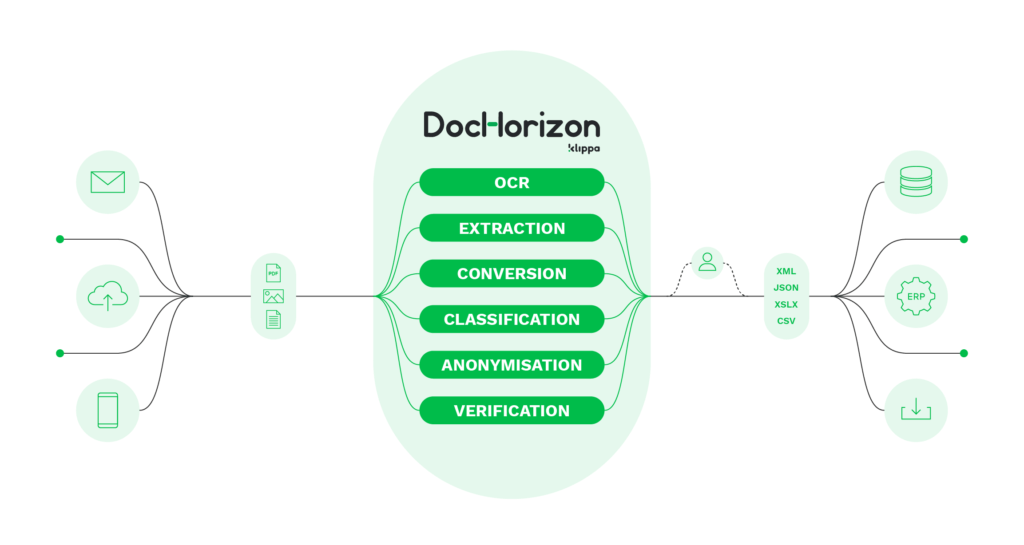

Klippa DocHorizon is an Intelligent Document Processing solution, that allows you to automatically scan, extract, verify, and classify data from financial documents, for an improved workflow.

Businesses can automate accounting tasks with smart business rules and OCR technology that can extract information from any financial document within seconds. Below you can find the most common reasons for our customers to use our software:

- Catch fraudulent documents

- Automatically parse documents for useful data

- Cross-check documents and data points, for example with two-way matching

- Seamless integration with existing software via API or SDK

- Duplicate receipt or invoice detection to avoid double payments

- Automated data entry for better operational efficiency

Don’t spend another minute struggling with manually processing financial documents or worrying about workflow efficiency! Book a free demo below or contact one of our experts if you have any other questions!