Verifying the origins of your clients’ income is an indispensable aspect of Know Your Customer (KYC) process. It’s also an essential step in complying with industry policies, such as Anti-Money laundering (AML). To verify that your customers’ funds are not of a criminal nature and don’t originate from high-risk activities, you’d employ Source of Funds and Source of Wealth verifications.

If you are not sure what these verifications entail or what sets them apart, we are here to help. In this blog, you will learn the difference between source of funds and source of wealth, and how they help improve KYC checks. Let’s start!

What is Source of Funds (SoF)?

Source of funds refers to documents specifying the origins of particular funds involved in a transaction. Besides establishing the origin of your client’s financial assets, you also need to determine how those funds were generated.

Some examples of sources of funds include personal savings, gambling winnings, sale of property or inheritance, and gifts. Having a clear overview of your customers’ source of funds enables you to ascertain their credibility and ensure that the money involved in a transaction is not coming from illegal activities.

What is Source of Wealth (SoW)?

Source of wealth refers to documents stating one’s accumulated wealth over a lifetime. This check goes deeper into the financial portfolio of your client, covering not only their immediate cash flow but the entirety of their accumulated wealth.

Examples of sources of wealth can be employment income, inheritances, investments, or shares in a business venture. SoW goes into the history of your client’s overall financial portfolio, ensuring their assets are the result of legitimate practices and that they have not been involved in any criminal activity.

Source of Funds vs. Source of Wealth

While both elements are used in AML and KYC checks, they serve different purposes. SoF is transaction-specific, while SoW evaluates the entirety of a client’s accumulated wealth. Understanding the nuances between the two is vital for financial institutions to effectively act against financial crimes.

For instance, if you’re a real estate agency and a customer wants to purchase a house, it is mandatory to check the source of funds for the transaction, before drawing up any contracts. This measure ensures that the customer did not get ahold of the money by any illegal means, which could later on be associated with your business.

When it comes to income declaration, for instance, a SoW would be more appropriate. This is needed so that your organization, be it a corporation, governmental institution, or bank, can have an overview of your clients’ wealth and spot any possible financial inconsistencies, and have the chance to report them accordingly.

What Makes SoF & SoW So Important?

Source of Funds and Source of Wealth are not just another bureaucratic task – they are indispensable in protecting your business from external financial risk, possible fines tied to mandatory regulations and even reputational damages. Let’s see some real-life applications of SoF and SoW in the contexts of KYC and AML.

Ensuring Trust in Banking and Financial Services

In banking, SoF and SoW checks are necessary for verifying the legitimacy of funds and the financial history of clients. Whether it’s opening a new bank account, processing large transactions, or processing loan applications, these checks help banks prevent money laundering and adhere to AML regulations.

For instance, before approving a mortgage, a bank would use SoF checks to ensure the down payment originates from legitimate sources, and SoW checks to verify the overall wealth of the applicant, so the bank is certain that the client can indeed afford to pay back the loan.

Securing Transparent Property Transactions in Real Estate

The real estate sector frequently employs SoF and SoW checks to guarantee the integrity of money used in property purchases. This is particularly relevant in high-value transactions, where the risk of money laundering is greater. Real estate agents and companies conduct these checks to understand the financial background of buyers and ensure compliance with AML directives.

Customer Due Diligence for Legal Services

Law firms and corporate organizations implement SoF and SoW checks as part of their customer due diligence processes. These checks are crucial when setting up trusts, managing estates, or providing advisory services on mergers and acquisitions. They help legal professionals ascertain the legality of funds and assets of potential stakeholders.

Income Proofing for the Gambling Industry

Due to its nature, the gambling industry is prone to high financial risks, in comparison to other entertainment industries. Hence, as part of their protocol, income verifications and identity verification in gambling is now mandatory. To ensure legal and responsible practices, users are asked to provide sources of funds before engaging in any activity, as well as identity verification.

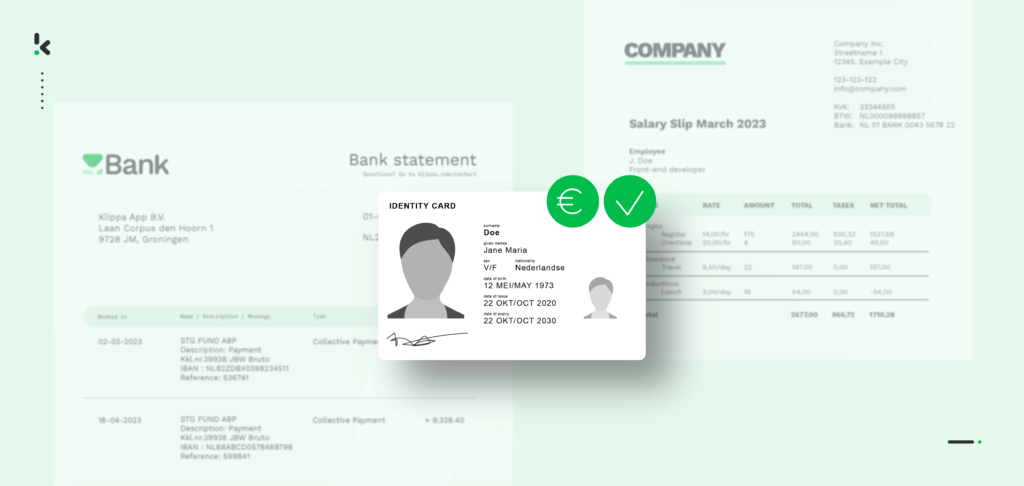

These verifications include showing salary slips, any source of funds documents, as well as valid identification documents, such as passports or identity cards.

How to Verify SoF and SoW

Verifying the source of funds and source of wealth implies verifying a variety of financial documents, by which an individual can prove the origin of their income and wealth. For example, when there is a need to verify the source of funds, you may ask a customer for:

- proof of investments

- financial records from the past 10 years

- savings account statements

- bank statements

On the other hand, if you are in the position of verifying the source of wealth, your customer should provide you with:

- past employment contracts

- salary slips

- inheritance document

- business ownership records

It requires thorough document processing, as your organization is not only responsible for checking the values presented in the files but also verifying the authenticity of these documents, as well as checking them against the data previously provided by the customer. Since the majority of such documents come in paper format, going through all of them takes a long time and frankly, it is a rather error-prone task.

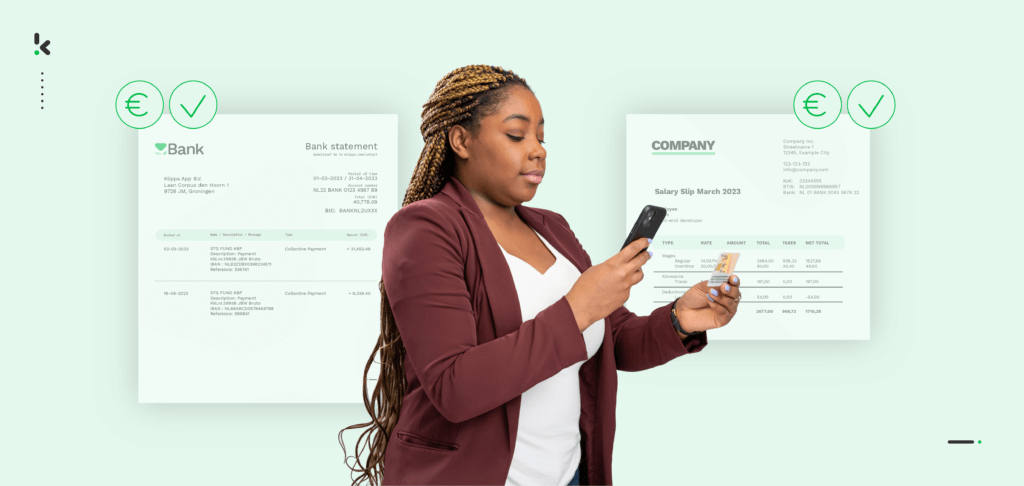

To be able to process these documents accurately and not spend a large amount of time on this task, many organizations have opted for automating the verification of SoF and SoW. By employing smart automation solutions, such as Klippa DocHorizon, your business is able to process all of the required financial documents accurately and securely in record time.

Simplify SoF and SoW Verification with Klippa

Klippa DocHorizon is an intelligent document processing solution that redefines traditional KYC checks and automates the workflows involved in verifying financial backgrounds.

Besides processing and extracting relevant data and sending it to your organization’s database, DocHorizon employs a series of features designed to improve the entirety of the SoF and SoW checks.

Automating the whole workflow can bring a number of benefits to your business, such as:

- Ensured authenticity and fraud detection with smart document verification

- Up to 99% accuracy by means of AI-powered OCR for data extraction

- Shortened document processing times due to bulk processing capabilities

- Smart financial document archiving with document classification and sorting

- Being in control of data with GDPR-compliant and ISO-certified software solution

- Protection of sensitive information with data masking and anonymization

There is no compromise when it comes to the financial health and compliance of your business and clients. If you’re interested in knowing more about how you too can automate verification of source of funds and source of wealth, contact our experts or book a free demo down below!