As a rental property owner or manager, you are all too familiar with the scenario when tenants fail to pay rent on time. As of 2023, approximately 11.5% of renters in the United States were behind on their rental payments. In 2024, the situation wasn’t any better. Half of renters are paying nearly a third of their income on rent, underscoring the financial strain faced by many renters. No wonder so many landlords lose sleep over unpaid rent!

Even more, these situations often escalate quickly into legal complications, including eviction proceedings, and can leave you struggling with a cash flow shortage to cover the mortgage.

However, there is a silver lining: by prioritizing tenant income verification, you can proactively prevent these problems from arising. Want to learn more? In this blog, we will guide you through the process of verifying a tenant’s income and introduce you to solutions that can automate this process. Keep reading!

Key Takeaways

- Tenant income verification ensures applicants can afford rent, reducing financial risks. It helps prevent late payments and costly eviction processes, protecting rental property owners or managers from vacancies and revenue loss.

- Manual verification is time-consuming, error-prone, and difficult to scale. Digital verification, on the other hand, is faster, automated, and highly accurate with built-in fraud detection.

- Digital tenant income verification speeds up rental approvals with near-instant processing. It minimizes human errors, improves efficiency, and allows landlords to focus on property management.

- Klippa’s Tenant Income Verification automates ID and income verification in seconds. It offers NFC checks, biometric verification, and fraud detection so you can confidently screen tenants, minimize risks, and secure long-term rental stability.

What is Tenant Income Verification?

Tenant income verification is the process of confirming a tenant’s income to see if they meet the financial requirements to rent a property. Landlords, property managers, and housing authorities use this verification to assess whether a tenant can afford rent and comply with lease terms.

Verifying a tenant’s income is more than just a simple formality. It goes beyond ensuring the tenant has the financial ability to afford your property. Here’s why it’s so important:

- Financial Reliability: By verifying tenant income before signing any legal agreements, you can ensure that prospective tenants are capable of making monthly payments on time, thus guaranteeing a consistent cash flow for you.

- Risk Mitigation: By preventing tenants who may struggle to pay the rent from moving in, you can avoid the costly and time-consuming process of evictions down the line. With this proactive step, you also shield yourself from having to look for a new renter at the last minute, which could also result in delays in your revenue if finding a suitable replacement takes a long time.

As you can see, ignoring this essential step could result in financial losses and other unpleasant consequences. To help you steer clear of such outcomes, let’s walk through how you can verify tenant income.

How to Verify a Tenant’s Income

Before you rent out a property, you must determine the minimum income that an applicant needs to earn each month in order to pay the rent. An easy method is to follow the 3:1 income-to-rent ratio, which means a prospective tenant’s gross income should be at least three times the rent. For instance, if the rent is $1000 per month, the applicant must earn a minimum of $3000 per month.

However, rental markets can vary greatly from city to city and year to year, so make sure to research your local market to understand its value.

Once the income-to-rent ratio is determined, you can then proceed to evaluate the applicant’s income and request proof of income for verification. To do so, first, you need to know the employment type of your prospective tenant.

In this section, we’ve listed all of the possible document types for you!

Employed Tenant’s Income Verification

For prospective tenants with an employer, the most common documents to request are:

- Salary slip. The best way to check for the exact income that tenants are earning is through salary slips.

- Employment statement. To confirm the tenant’s employment status and monthly salary rate, you can also request an employment statement.

Self-Employed Tenant’s Income Verification

It may not be as straightforward for self-employed tenants, but their income can still be determined through:

- Tax returns. An overview of the tenant’s yearly income can be found on tax return statements. It’s a reliable way to verify income for those who don’t receive salary slips.

- Bank statements. For entrepreneurs, bank statements can also be required to demonstrate what they earn and if they have enough money in their bank account.

Unemployed Tenant’s Income Verification

Unemployed individuals can obtain a variety of documents to provide as proof of income for rental purposes.

- Social Security statement. With this statement, you can easily verify the government income that a potential tenant receives.

- Annuity statement. Annuity statements help verify the amount of regular income received from an annuity, which can often replace a paycheck in retirement.

- Pension distribution statement. These forms are used to state the allocation of pensions (Forms 1099-R and statements for IRAs, for instance).

- Unemployment statement. This document is issued by the government to demonstrate the income compensation received by individuals who do not have an employer.

Methods of Tenant Income Verification

Once you have the right documents, it’s time to start the verification process! You can do it in one of two ways:

- Manual income verification

- Digital income verification

1. Manual Income Tenant Income Verification

Manual income verification is the process of manually collecting and reviewing paper-based documents from applicants. Firstly, you, as a rental property owner or manager, need to ask the applicants for specific financial documents to verify their income.

Then, you must carefully inspect them for consistency, relevance, and accuracy. In some cases, you must also reach out to the applicant’s employer to confirm employment and income details.

Phew! This sounds like a lot of work, right?

Also, manual verification works well for handling a small number of renters but becomes challenging to scale with a larger volume of properties and tenants. Manual checks lack scalability and may result in overlooking crucial details or potential document fraud, posing long-term risks.

What is there to be done?

2. Digital Income Verification

The answer is digital verification. This type of verification leverages automation through advanced software, empowering you to maintain control over the process without requiring extra resources for exhaustive document checks. This approach is ideal for established businesses or those experiencing rapid growth, offering a future-proof solution.

Comparison: Manual vs. Automated Income Verification

Verifying tenant income is a critical step in securing reliable renters, but the method you choose can significantly impact efficiency, accuracy, and risk management.

Traditional manual verification requires collecting, reviewing, and validating financial documents by hand, making it time-consuming and prone to human error.

On the other hand, AI-powered income verification automates the process, offering faster, more accurate, and fraud-resistant results. Below is a comparison of both methods to help you decide which best suits your rental screening needs.

| Feature | Manual Process | AI-powered Process |

| Processing time | Slow (days) | Instant (minutes) |

| Fraud detection | Low | High |

| Accuracy | Prone to errors | 99% accuracy |

| Compliance risk | Higher | Lower |

In the next section, let’s dive into how the digital tenant’s income verification process works so you can witness the possibilities for yourself.

How Digital Tenant Income Verification Works

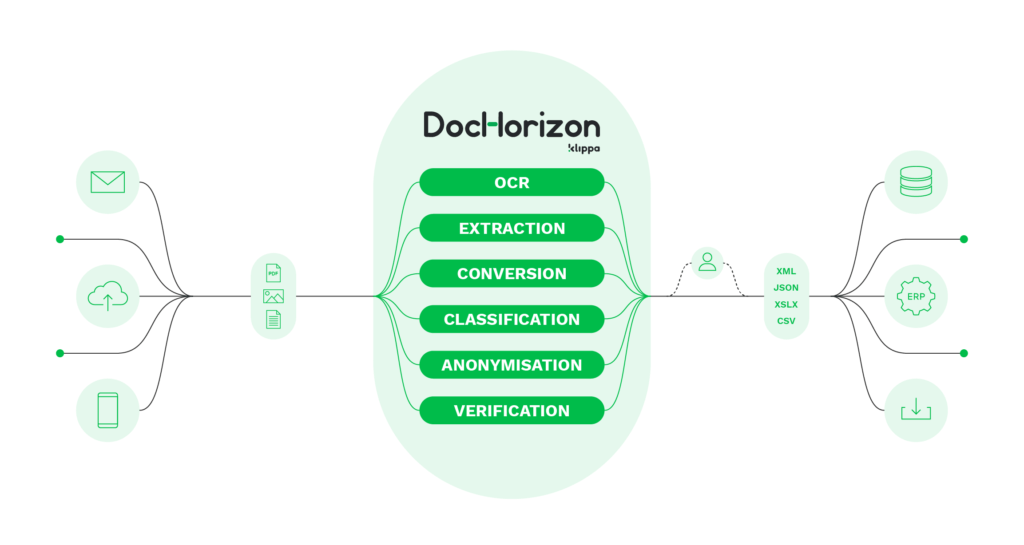

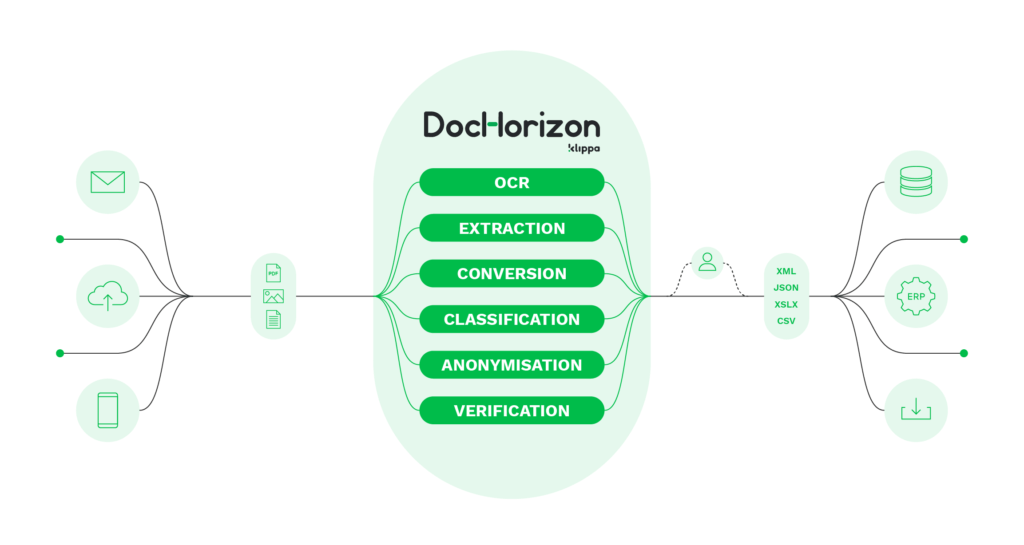

Digital tenant income verification transforms how you can verify the income of your tenants, thanks to Intelligent Document Processing (IDP). It uses several cutting-edge technologies, such as AI (Artificial Intelligence) and OCR (Optical Character Recognition).

This method provides a faster and more secure way to validate tenant income without the need for paperwork. This is a reliable process to ensure the financial viability of your tenants. Let’s see how it goes:

- Document Collection: Your prospective tenant can be requested to provide income-related documents via email or your website. Depending on the employment type, they can submit salary slips, tax returns, bank statements, employment verification letters, or any document that allows you to verify their income.

- Document Extraction: The software automatically extracts relevant information from the uploaded documents using OCR technology. This includes names, income amounts, company, or job details.

- Data Validation: The extracted data is validated for accuracy and completeness to ensure that the provided information is consistent and reliable. Built-in AI algorithms allow for automated fraud detection by spotting any signs of tampering or irregularities.

- Data Transfer: Once the data is validated, the software converts it into a format that can be easily used in your software of choice and then forwards the data. Excel, JSON, CSV, or any format is possible! This makes it easy to find the information needed to calculate if a tenant earns enough.

As you can see, embracing digital verification with IDP software makes document processing a breeze. And the benefits don’t end here!

Benefits of Digital Tenant Income Verification

The digital income verification process is a go-to if you’re looking for an efficient way to handle your tenant’s documents:

- Faster transactions: You can process rental applications in no time, resulting in quicker financial transactions or commission payouts.

- Accurate tenant information: Automated document checks minimize errors, ensuring that your decisions are based on precise data.

- Higher productivity: Getting rid of manual tasks allows you to focus on your business growth or building a good relationship with your tenants.

- Positive landlord and tenant experience: If you have your own platform, digital verification offers quick and seamless verification, which contributes to a positive experience for both parties.

Now that you have learned everything about tenant income verification, let us introduce you to the perfect fit for you.

How Can You Automate Tenant Income Verification With Klippa?

Identity verification has never been easier with Klippa’s Automated Tenant Income Verification. In just a few seconds, potential tenants’ details can be verified based on some verification requirements you’ve set! Below are all the steps you can select for your verification process:

- 1. Start Verification: The tenant submits their personal and financial documents through a digital platform, such as an app or a website.

- 2. Document Capture: If document verification is part of the process, the tenant takes a picture or scans their ID and income documents using a smartphone camera, webcam, or file upload.

- 3. NFC checks: For identity verification, the tenant may be prompted to scan their passport or ID using NFC if it contains a chip, ensuring authenticity.

- 4. Data Extraction: Klippa extracts relevant information from the provided documents, verifies their authenticity by using fraud detection automation, and checks for any signs of tampering or inconsistencies.

- 5. Biometric Verification (Optional): To prevent identity fraud, biometric verification can be added. Tenants may be required to take a selfie or complete a liveness check to ensure they are the rightful document holders.

- 6. Data Comparison: Klippa then compares the extracted data (and biometric information) against the tenant’s provided information.

- 7. Verification Result: Once the verification is complete, the system provides a result. If the tenant’s identity and income details are confirmed, they can proceed with the rental process. If inconsistencies are found, the application may be flagged for additional review.

And that’s it! Fast and easy, it streamlines tenant screening so you can make informed rental decisions with confidence. Ready to level up your tenant income verification? Please contact us or book a demo below.

FAQ

Landlords can verify tenant information by requesting a government-issued ID and using identity verification software to confirm authenticity. They should also review pay stubs, bank statements, or tax returns and confirm employment directly with the employer. Rental history can be checked by speaking with previous landlords. Once verified, tenants should sign a lease, ideally with electronic verification for added security.

While a credit score indicates financial responsibility, it doesn’t confirm current income levels. Therefore, it’s essential to verify income separately to ensure the tenant can afford the rent.

Landlords should cross-verify information and compare pay stubs with bank statements for consistency, reach out to the employer’s HR department to confirm employment details and use professional verification services to detect fraud easily, just like Klippa does.

Yes, automated income verification solutions like Klippa’s can streamline the process by quickly processing documents, reducing manual effort, and utilizing algorithms to spot discrepancies or fraudulent activity.

Currently, Klippa supports all Latin languages. Our engine performs best in English, Dutch, Norwegian, Danish, Swedish, Finnish, Italian, Portuguese, Spanish, German, and French. However, other languages can be supported on request. We’re open to training our machine-learning models, so if you have a specific case, don’t hesitate to contact us!