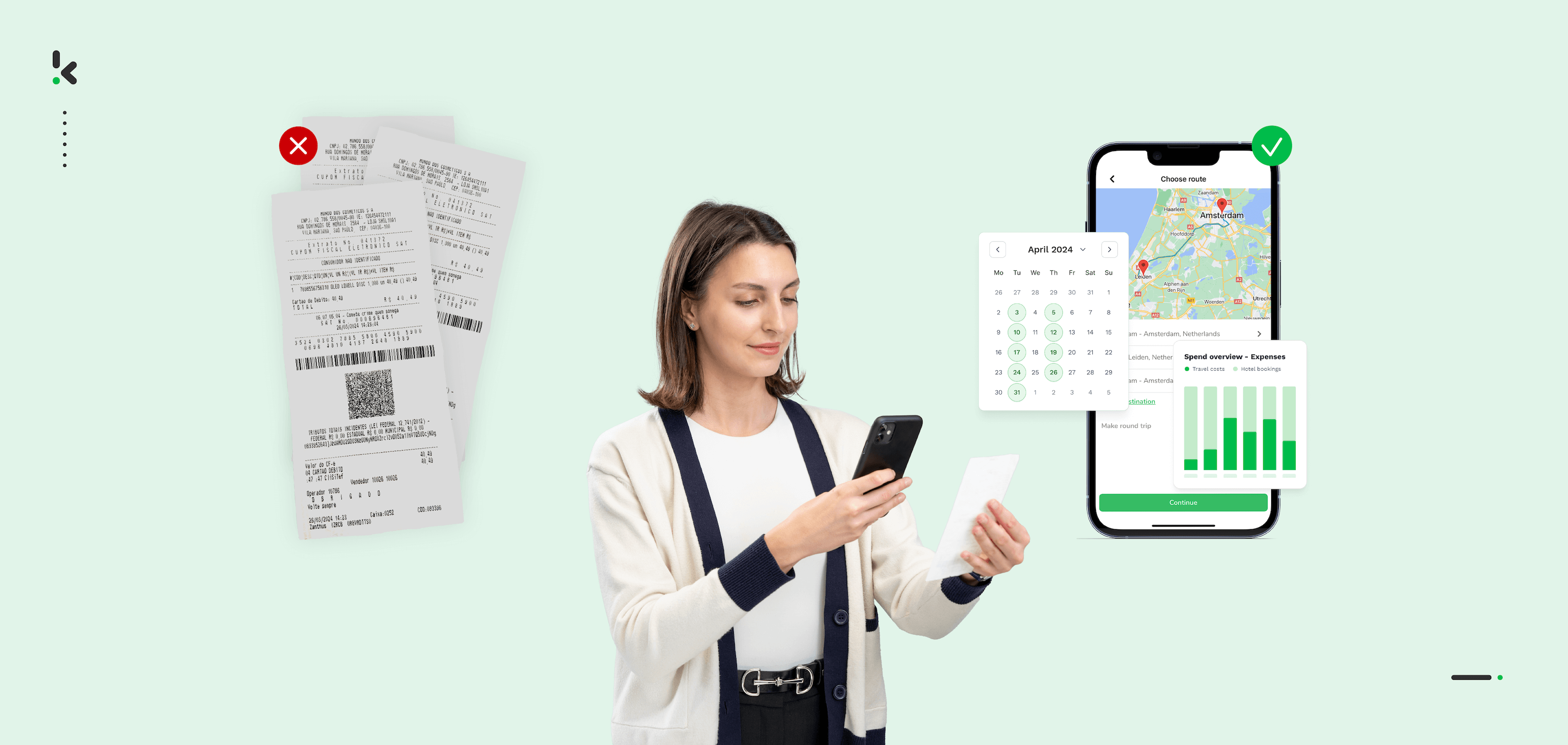

Juggling travel plans and expense reports, with its manual data entry, misplaced receipts, and the constant threat of expense fraud, is no small feat regardless of your team size.

Thankfully, it doesn’t need to be time-consuming or dreadful. The use of expense management software offers finance departments a lifeline to turn the chores of paper expense reports, reimbursement processes, and time-consuming approvals into a breeze.

In this blog, we take a comprehensive dive into Travel and Expense Management (T&E). By the end of it, you will have a better understanding of the common challenges, and how you can do it better by selecting the right expense software for T&E.

What is Travel and Expense Management?

Travel and expense management refers to policies and procedures for managing business travel expenses, including booking travel and accommodations, submitting expense reports, and reimbursing employees for out-of-pocket expenses.

Managing travel expenses involves the use of strategies, corporate travel management tools, and guidelines to control costs while enforcing compliance with internal policies and tax regulations.

Proper T&E management helps companies gain visibility into their travel spend, avoid expense fraud, make data-driven decisions to cut unnecessary costs, and simplify travel and expense processes for both employees and administrators.

Why is T&E Management Important For Your Business?

Effective travel and expense management is essential for keeping your business on track financially. It ensures that every dollar spent on travel and expenses is accounted for, helping you avoid budget overruns and unnecessary costs.

With a clear system and expense policy in place, you can see exactly where money is going, make smarter spending decisions, and reduce time spent on manual processes.

Good T&E management also helps your business stay compliant with policies and regulations, reducing the risk of errors or employee fraud. In short, it helps you save money, stay organized, and protect your business.

What is the Travel and Expense Policy?

A Travel and Expense policy is a set of guidelines, typically presented in a physical or digital document, that companies use to manage and control employee travel expenses. This policy ensures that travel costs stay within budgetary limits and align with business objectives, such as sustainability, reputation, and safety.

The policy also helps administrators ensure that employees do not choose luxury options for reimbursable expenses like meals and accommodation. Additionally, it prevents any misunderstanding that non-business-related expenses, such as personal entertainment, could be reimbursed by the company.

How to Design an Effective T&E Policy

Companies can use a travel and expense policy to establish clear rules, rates, and procedures on making and claiming travel expenses. While your policy should reflect your business objectives, typical travel and expense policy will include the following components:

- Travel Authorization: Procedures for obtaining approval for business travel, including required documentation.

- Booking Travel: Guidelines on booking transportation and accommodation for domestic and international travel with the list of preferred vendors or travel agencies, if applicable.

- Transportation: Policies regarding the use of company vehicles, personal vehicles, and rental cars. Reimbursement rates for mileage and parking expenses.

- Accommodations: Limits on costs per night and policies on incidental expenses (e.g., room service, laundry).

- Meals and Entertainment: Per diem allowances or reimbursement policies for meals.

- Expense Reporting: Procedures for submitting expense reports, including required documentation and timelines with policies on receipt retention and submission.

- Reimbursements: Details on how and when employees will be reimbursed for approved expenses.

- Non-reimbursable Expenses: Clear list of expenses that will not be reimbursed (e.g., personal shopping, fines, alcohol).

- Compliance and Violations: Consequences of non-compliance with the policy.

- Health and Safety: Procedures for emergencies or unexpected situations during travel.

The foundation of any effective T&E management process is a clear and comprehensive expense policy. It’s crucial that this policy is easily accessible to all employees and well understood by them. Regular updates are also essential to keep the policy aligned with changes in travel costs, business priorities, and tax laws.

6 Stages of the T&E Management Process

Travel and expense management typically involves several steps that help ensure the process is efficient, compliant, and cost-effective. Here are the key stages:

1. Planning and Pre-Approval

- Travel Request Submission: The employee submits a travel request outlining the purpose, destination, dates, and estimated costs of the trip.

- Managerial Approval: The travel request is reviewed and approved by a manager or supervisor, ensuring it aligns with business objectives and budget constraints.

- Budget Allocation: The trip’s expenses are allocated against the relevant department’s budget to track spending.

2. Booking Travel Arrangements

- Booking Transportation: The employee books flights, trains, or other transportation through approved vendors or travel agencies, following company policies on class of service and preferred providers.

- Accommodation Reservation: The employee books accommodations that comply with company policies on cost and location.

- Other Arrangements: Additional arrangements, such as car rentals or travel insurance, are made as needed.

3. Travel Execution

- Travel Documentation: Employees are responsible for keeping all receipts and documentation related to travel expenses, including boarding passes, hotel invoices, meal receipts, and any other relevant costs.

- Expense Tracking: Throughout the trip, employees should track their expenses using either manual logs or digital tools provided by the company.

4. Travel Expense Reporting

- Expense Report Submission: After the trip, the employee compiles all receipts and submits a travel expense report within the designated time frame. This report includes details of all expenses incurred and any supporting documentation.

- Expense Categorization: Expenses are categorized according to the company’s guidelines, such as transportation, accommodation, meals, and incidentals.

5. Review and Approval

- Expense Report Review: The expense report is reviewed by the employee’s manager or the finance department to ensure all expenses are justified, compliant with the policy, and properly documented.

- Approval or Rejection: The expense report is either approved for reimbursement or flagged for further review if discrepancies or policy violations are identified.

6. Reimbursement

- Processing Reimbursements: Once the expense report is approved, the finance department processes the reimbursement. The employee receives payment for approved expenses, typically within a specified period (e.g., 30 days).

- Audit and Compliance Check: Some organizations may conduct random audits of expense reports to ensure ongoing compliance with the travel and expense policy.

As you might have noticed, the stages outlined above include numerous manual tasks such as receipt saving, manual logging, and expense categorization. Despite careful planning and oversight, these tedious methods often complicate the entire process. As we move into the next section, we’ll explore some of the most common challenges of the T&E management.

Common Challenges of T&E Management

Managing travel and expenses without the right tools can quickly become a headache full of paperwork, lost receipts, and endless approvals. The process, often riddled with inefficiencies and delays, not only frustrates employees but also strains your finance team.

Below are some of the most common challenges businesses encounter when relying on manual T&E management:

- 1. Tedious Manual Processes: Handling T&E manually often means piles of paperwork, lost receipts, and hours spent on data entry. This inefficiency not only eats up valuable time but also increases the likelihood of errors. When employees have to manually log expenses and managers sift through endless reports, the process becomes a frustrating bottleneck.

- 2. Lack of Spend Visibility: Without real-time tracking, you’re essentially flying blind. Manual processes delay expense reporting, making it difficult for finance teams to get a clear picture of spending until it’s too late. This lack of visibility can lead to budget overruns and missed opportunities to control costs.

- 3. Slow Reimbursements: Delayed reimbursements are a common gripe among employees. When expense reports are stuck in approval limbo or buried under layers of bureaucracy, it can take weeks or even months for employees to get reimbursed. This not only frustrates your team but can also lead to cash flow issues for those who travel frequently.

- 4. Policy Compliance Issues: Ensuring that all employees adhere to your T&E policy is challenging, especially as your company grows. Without automation, it’s easy for unauthorized expenses to slip through, whether due to oversight or deliberate non-compliance. This can result in unnecessary spending and potential policy violations.

- 5. Risk of Expense Fraud: Manual T&E management can leave your company vulnerable to fraud. Whether it’s intentional misreporting of expenses or unauthorized use of company funds, the absence of strict controls and automated checks makes it easier for fraudulent activities to go unnoticed.

- 6. Complicated Approval Workflows: In a manual setup, getting approvals for t&e expenses often involves multiple layers of management and endless back-and-forth communication. This not only slows down the process but also creates frustration for employees who need quick approvals to move forward with their travel plans.

- 7. High Administrative Costs: The hidden cost of manual T&E management is often overlooked. Processing each expense report manually takes time, and correcting errors takes even more. This inefficiency can significantly increase your administrative overhead, making the entire process more expensive than it needs to be.

Understanding the challenges of business travel and expense management allows you to evaluate the complexity and the impact of these issues on your operations. By recognizing the specific pain points, you can better prepare to address them in your T&E management strategies.

Best Practices for Managing Travel Expenses

When dealing with business travel and expense management, adopting strategic practices can improve operational efficiency, reduce costs, and ensure regulatory compliance. Let’s delve into more practical, detailed insights that can be particularly valuable for businesses seeking to optimize their travel and expense processes.

Let’s dive into more practical tips on how you can further optimize your travel and expense processes.

Establish Clear Expense Policies

The foundation of effective T&E management is a clear, comprehensive expense policy. Your policy should detail what is reimbursable, set daily limits for various expense categories (like meals, lodging, and transportation), and outline the approval process.

It’s important to ensure that the policy is easily accessible to all employees and that they understand it. Regularly updating the policy to reflect changes in travel costs, business priorities, and tax laws is also essential.

Partner with Specific Travel Vendors

Negotiating business rates with specific airlines, hotel chains, and car rental services can lead to substantial savings and perks. This strategy not only locks in lower rates but can also secure benefits such as free Wi-Fi, breakfast, late check-out at hotels, and complimentary upgrades or priority boarding on flights.

Provide Company Credit Cards with Spending Limits

Issuing business credit cards for operational budgets can simplify travel expense tracking and increase cost control. With spending limits and custom restrictions, you can regulate spending while providing flexibility. This practice also helps in consolidating expense data, making it easier to identify cost-saving opportunities.

Moreover, selecting credit cards that offer travel perks can enhance the travel experience for employees while benefiting your company. Look for cards that provide rewards points, travel insurance, no foreign transaction fees, or other travel perks.

Integrate Expense Management Software

Expense management software can simplify T&E processes by automating expense processing tasks such as report generation, approval workflows, and reimbursements. This software utilizes technology like AI and Optical Character Recognition (OCR) to reduce manual input and protect your organization from fraud.

Opt for software that offers comprehensive features, such as real-time travel and expense reporting, receipt scanning application, integrated mileage tracking, synchronization with credit cards and direct integration with your accounting software.

Regularly Review and Analyze Expense Data

Regular analysis of expense data can reveal trends, pinpoint areas of overspending, and identify opportunities for additional savings or policy adjustments. This analysis should cover vendor usage, compliance rates, and expense types. Utilizing this data effectively can help in renegotiating contracts with suppliers or adjusting policies to better align with actual spending patterns.

Selecting the Right T&E Management Software

Automated expense management is not just a convenience but a necessity for keeping your business finances transparent, controlled, and compliant. The right software can ensure that your company’s t&e expenses are managed efficiently and effectively.

Let’s dive into the technical functionalities and specific benefits of each must-have feature that can help you automate your expense management:

Automated Receipt Capture

Receipt capture reduces manual data entry, minimizes errors, and accelerates the travel and expense reporting process. The following feature utilizes OCR technology to extract data from receipts captured using a smartphone camera. Then, AI automatically populates expense entries with extracted information such as date, amount, vendor, and expense category.

Multi-Level Approval Flows

Automated approvals guarantee compliance with company policies by applying custom business rules and involving relevant personnel in the approval process. With most software, users can set different thresholds for expense amounts that can allow automatic approvals or require high-level clearance from C-level executives.

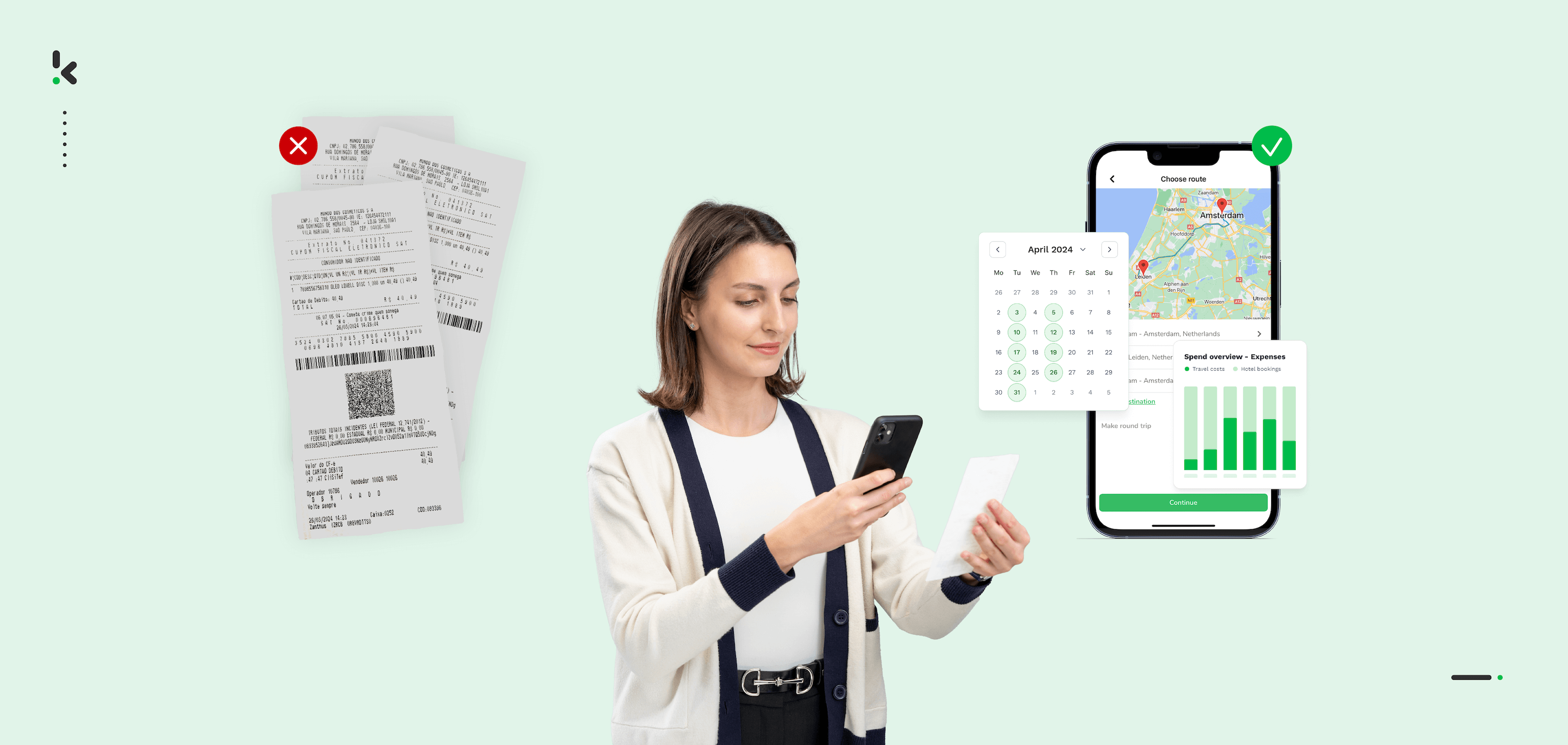

Mileage Tracking

The in-app mileage reporting automates mileage claims by employing map integration or GPS technology to accurately track mileage for business travel. Users can start and end a trip within the app, and the software calculates the distance and applies the current mileage rate to determine reimbursement amounts.

Multi-Currency Support

Automatic currency conversion simplifies travel and expense reporting for international travel and ensures accurate financial records across global operations. This feature allows users to record expenses in any currency, which are then automatically converted into the business’s base currency at the current exchange rate.

Real-Time Expense Visibility

Accurate and instant statistics on your company spending offer instant insight into financial commitments and spending patterns, enabling proactive budget management and financial planning. Expense dashboards and built-in analytics provide a live overview of incurred expenses, approvals pending, and budget utilization with filters that enable quick access to specific data points.

Business Credit Cards

Physical and virtual corporate credit cards streamline reconciliation, enhance transaction visibility, and reduce fraudulent expense claims. Consider software that includes company credit cards in its offering or links all credit card transactions directly to the expense management system, automatically matching transactions to reported expenses.

By focusing on these technical functionalities and their direct benefits, you can better assess the potential impact of each feature on your travel and expense management processes, leading to more informed software selection decisions.

Manage Your Travel Expenses with Klippa

Managing business travel expenses can be tedious, but doesn’t have to be. Forget about the frustrations associated with T&E management by entrusting your travel expense processing to Klippa SpendControl. Submit, approve, and manage all business travel expenses with our OCR-powered pre-accounting solution. Reduce the hours-long process into several clicks.

Klippa SpendControl offers numerous features that will enhance your expense management in no time:

- Expense management and invoice processing in one centralized solution

- Complete cost control with business expense cards

- Expense submission, processing, and approval via web or mobile app

- Fully customizable approval management with smart business rules

- Compliance with tax and data privacy regulations

- Multi-currency support for international transactions

- Built-in duplicate and fraud detection

- Mileage tracking through Google Maps integration for travel reimbursement

- Intuitive expense dashboard for centralized financial control

- Integration possibilities with accounting and ERP software, like Xero, NetSuite, SAP, and many more

FAQ

Travel and expense management (T&E) refers to the policies and procedures that manage business travel expenses, including booking travel, submitting expense reports, and reimbursing employees for out-of-pocket costs.

The T&E process involves planning and pre-approval of travel, booking arrangements, tracking expenses during the trip, submitting expense reports, reviewing and approving expenses, and finally, reimbursing the employee.

Trip expenses are managed by following a clear T&E policy, using expense management software to track and submit expenses, and ensuring all costs align with company guidelines.

Travel expenses are generally deductible if they are ordinary, necessary, and directly related to the business. However, not all expenses are fully deductible; some may be subject to limitations.

A travel and expense specialist manages and oversees the T&E process, ensuring compliance with company policies, processing expense reports, and working to prevent fraud and control costs.