With each year, KYC (Know Your Customer) becomes progressively more important for businesses across all sectors. Presumably, you’re here because you, too, need to integrate KYC checks into your onboarding procedure.

Whether you’re on this path because it’s mandatory for your industry or to protect your interests, implementing KYC is a wise choice. It’s never a bad idea to identify and verify that your customers are who they say they are. More so, it’s the only way to guarantee that no money laundering or fraud takes place at your expense.

Since it’s not sustainable to ensure the authenticity of your clients based on how sincere they seem, there is a number of agreed-upon documents required for KYC checks. Curious to know more about it? Great! We won’t keep the suspense for long.

In this blog, we’re going to discuss what exactly KYC documents are, explore the different types of documents involved, and even highlight some of the perks of automating your KYC process.

What are KYC documents and which are required?

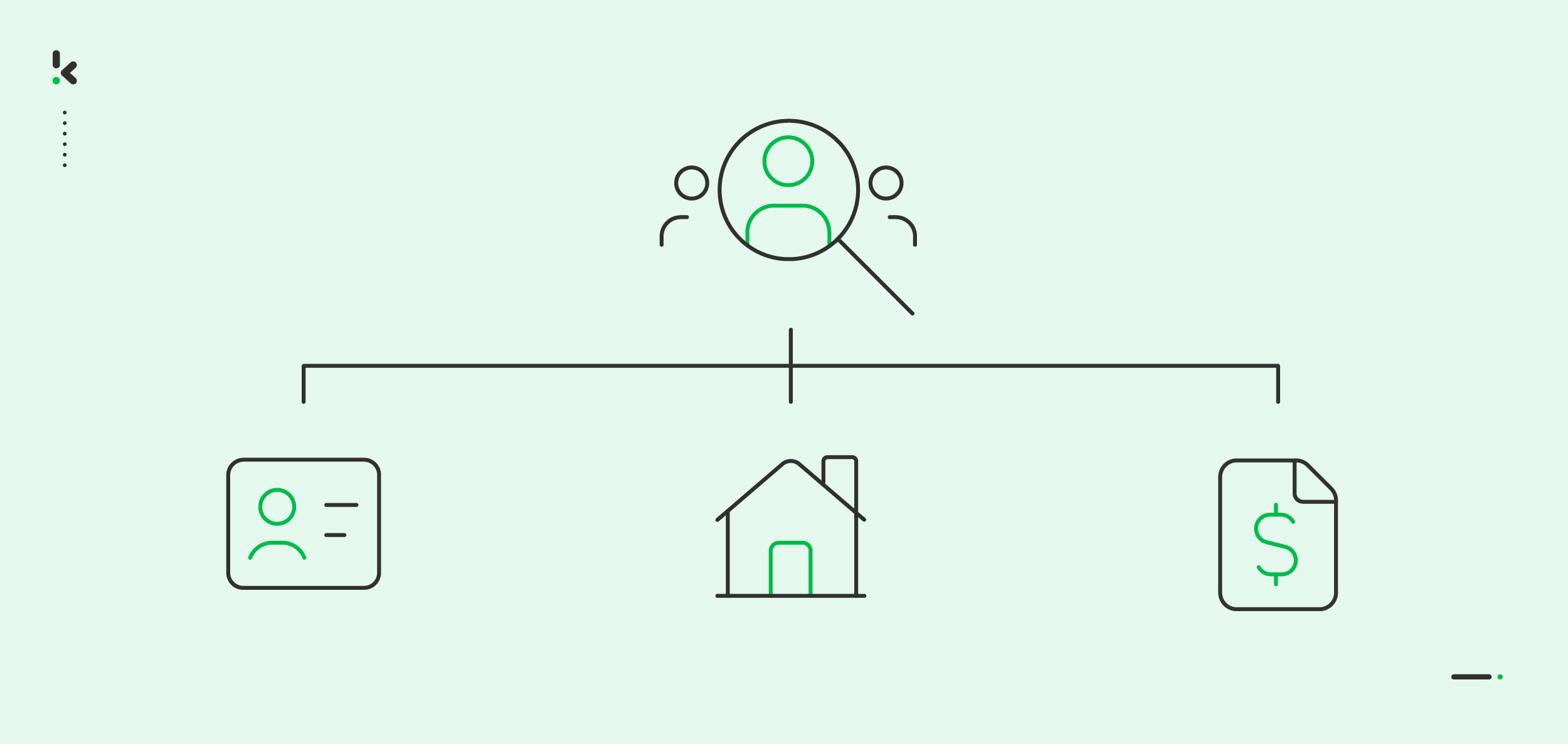

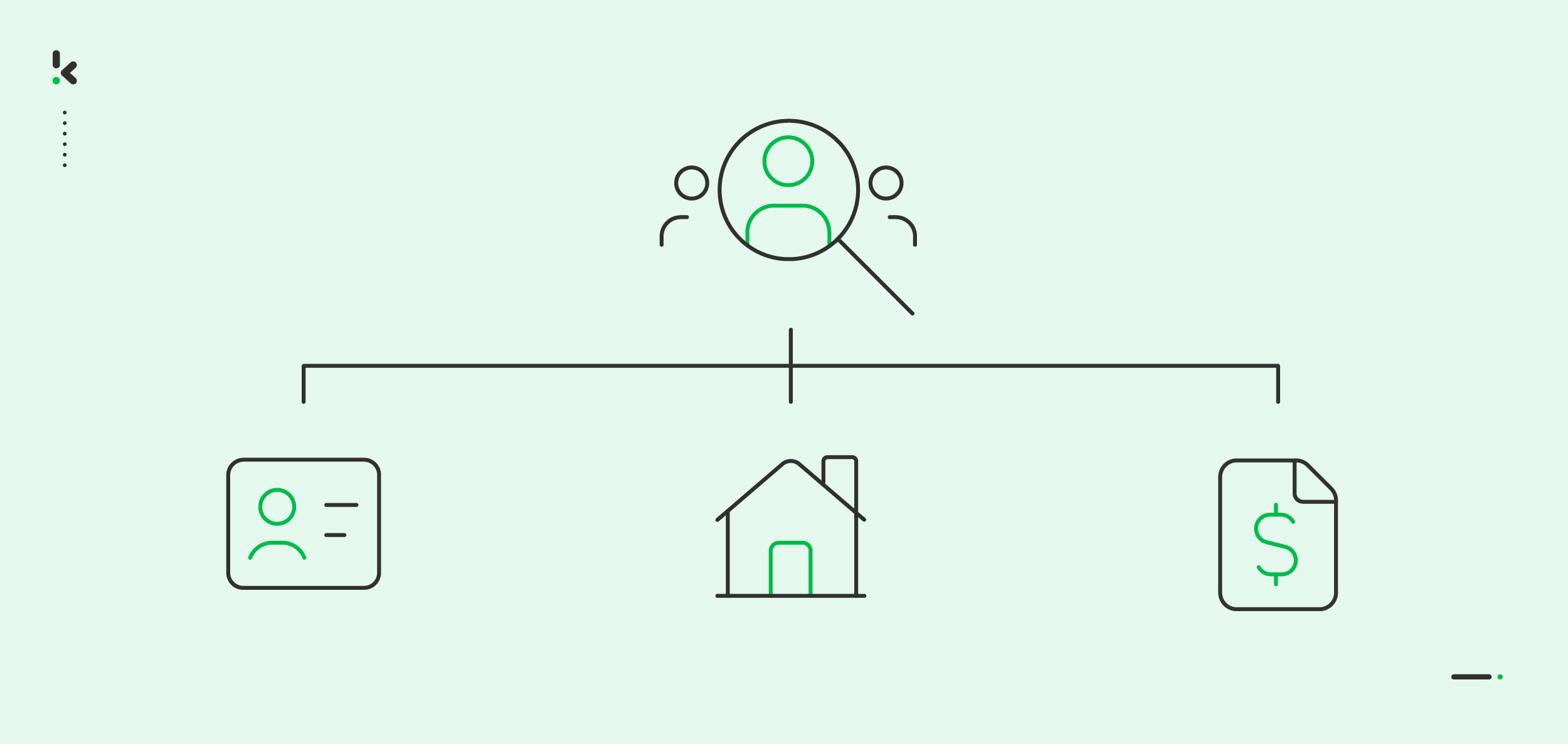

Know Your Customer documentation consists of the documents that assist you in verifying your client’s identity and obtaining any information relevant to your business industry. Generally, KYC documents are divided into three types: Proof of Identity, Proof of Address, and Proof of Income. In the following paragraphs, we will take a closer look at each of them and explain which documents can be used for such purposes.

Proof of Identity (PoI) documents

Proof of Identity documents are the backbone of all KYC processes. It’s not hard to guess that they are used to confirm whether the details you received are correct and belong to a real person.

Typically, you’ll need to check for a unique identification number, personal information like name, age, gender, or signature, and a photograph.

Passports, national ID cards, and driving licenses are the most commonly requested documents for this purpose. But, the list is not limited to these forms of identification.

Depending on the country and specific safety measurements, you can also use one of the following documents:

- Birth Certificate

- Citizenship Certificate

- Voter ID Card (in Mexico, India, Jamaica)

- Health Card (in Canada)

- Bank card with a photograph (often used for in-store checks in retail)

Proof of Address (PoA) documents

Even though PoI documents are usually sufficient for KYC checks, acquiring Proof of Address is just as vital in some cases.

As the name implies, such documents are essential for confirming someone’s residence at a specific address. For instance, if you’re a part of the financial sector, you may need to verify that your clients live at the address they listed during the onboarding process.

When you request PoA documents, ensure their validity. These documents should not be older than three months and must display a name that matches the name listed in the Proof of Identity (PoI) documents provided by your client.

Additionally, it should be visible that a document is issued by an officially-recognized organization with an address, name, and logo.

The examples of PoA documents are:

- Bills that were posted to your client’s address (e.g. utility bills)

- Bank statements

- Letters from a municipality

- Insurance letters

- Letter of employment

- Rental/mortgage contract

- Authorized change of address form

Proof of Income documents

Proof of Income documents are used less frequently but their importance can’t be overstated. This document type is needed to get accurate information on how much your clients earn over a period of time. This is how you can ensure that they have a steady source of income and are able to fulfill their obligations.

For instance, in the financial industry, you simply can’t do without such proof. With long-term financial commitments like mortgages and loans, it is essential to asses all risks prior to making the decision on granting a serious sum of money.

Payslips are the most commonly used documents for income proofing. However, there are more ways to check the income level of your customers. You can do this by requesting:

- Tax return letter

- Bank statement

- Statement of court-ordered payments (e.g. child support and alimony)

- Proof of unemployment benefits

- Pension slips

- Proof-of-Income letter

While we have provided you with a rather comprehensive overview of all KYC documents, please refer to the regulations for your sector and country to see which documents are necessary in your unique case.

Required KYC documents for banks and financial institutions

KYC is not the only legal obligation for the financial industry. CDD (Customer Due Diligence) and AML (Anti Money Laundering) regulations are also mandatory to comply with. And since verifying your customer’s details is a must according to both CDD and AML, KYC guidelines allow you to comply with both regulations.

Mostly, to get your clients onboard, you must obtain a full set of KYC documents. You’ll always need to ask for both Proof of Identity and Proof of Address. And, in the case of credits, mortgages, and credit cards, you’re also required to request Proof of Income.

So, a potential set of documents for your KYC process would be:

- Passport/ID card

- Official bill/letter posted to your client’s address

- Payslips for a calendar year/bank statement

Nonetheless, for banks and financial institutions, KYC does not end with initial verification. You also need to determine the level of risk each client may pose after their onboarding. In this case, EDD (Enhanced Due Diligence) and regular monitoring of your client’s financial transactions for any suspicious activities are also obligatory.

Automate KYC document processing with Klippa

With all the documents that you need for a thorough KYC check, just imagine how long it’s going to take to evaluate every single client manually. And the more clients you’ll have, the more employees you’ll need to be responsible just for the KYC process. These are extra expenses eating away at your revenue.

Automating all steps, or at least achieving partial automation, will revolutionize your game. The security features of current ID verification software enable more extensive checks than the simple visual evaluation that you perform when manually reviewing documents. Hence, automating this process is not only faster but also safer.

With Klippa’s Identity Verification solution, you save time, and cost and actually make one of the most important stages of your KYC procedure foolproof.

Forget about delays and eliminate unnecessary risks. Klippa’s solutions allow you to:

- Process and extract data from ID and PoA documents at a fast speed and in big volumes

- Automatically detect identity theft attempts

- Ensure documents’ originality with a built-in fraud detection

- Add an extra security step by including a liveness check, selfie identity verification, or NFC check in your onboarding process

- Seamlessly integrate ID verification with your web interface or mobile application

Slightly overwhelmed? No worries, we’ll be with you throughout the whole process from setting everything up to helping with the use.

You don’t have to commit right this moment. Book a free demo in the form below or contact us if you have any questions!