Running a business feels like a constant juggling act, doesn’t it? You’re trying to drive your business towards its goals while running the day-to-day operations smoothly. It’s exhausting and unsustainable.

Staying competitive demands more than just hard work; it requires strategic focus. But with your energy spread across multiple tasks, critical opportunities for growth and innovation are slipping through your fingers.

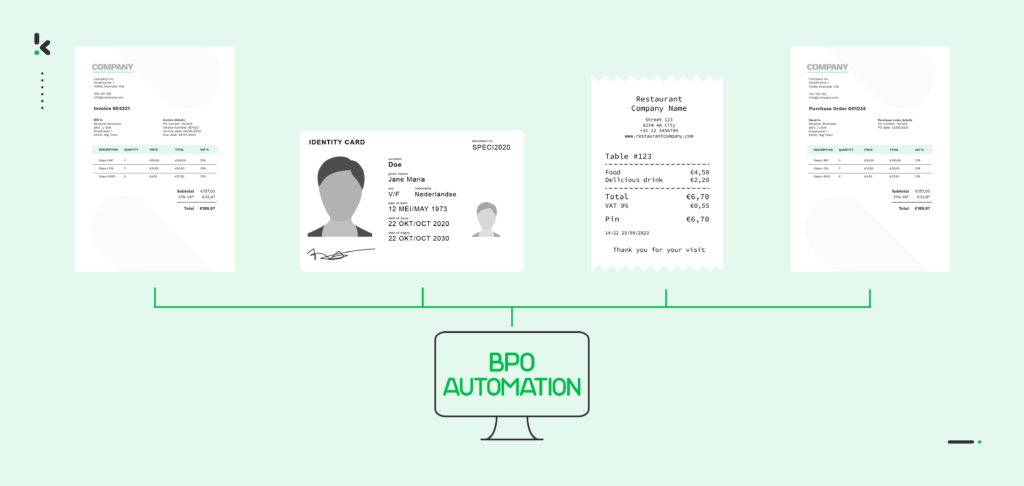

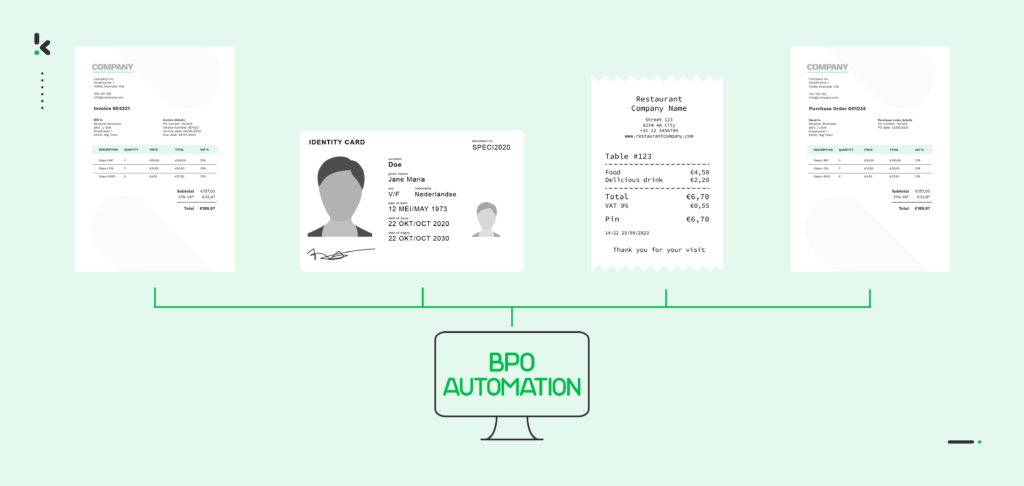

That’s where Business Process Outsourcing (BPO) automation comes in, like a secret weapon for solving annoying bottlenecks. Think of it as passing off the routine work to experts, so you can concentrate on growing your business and doing what you do best.

In this post, we’ll explore what BPO automation is, some use cases, and its benefits. Let’s get started!

Key Takeaways

- BPO Automation combines outsourcing with technologies like AI, OCR, and RPA to streamline repetitive, document-heavy processes.

- Businesses can achieve significant cost savings (often up to 50%), faster turnaround times, and improved accuracy while focusing on core activities.

- Common challenges include loss of process control, data privacy risks, and potential vendor dependency, making provider selection critical.

- Klippa’s BPO automation delivers superior accuracy, seamless integration, EU-based compliance, and measurable ROI through AI-powered document processing with human validation.

What is Business Process Outsourcing (BPO)?

Business Process Outsourcing (BPO) refers to hiring third-party service providers to perform specific business functions or processes. Imagine handing over the time-consuming, yet crucial, bits of your business to a team of experts.

This strategic move allows companies to allocate their internal resources more effectively, focusing on core activities that drive growth while outsourcing non-core, yet essential, operational tasks.

What is BPO Automation?

BPO automation utilizes technology to automate repetitive tasks and services complemented by human validation with the goal of improving productivity and significantly reducing costs.

This entails delegating specific business tasks like data entry, document verification, and processing across various departments, such as finance & accounting, human resources, or back-office functions to a business processing outsourcing services provider.

Now that you know more about what BPO is, let’s explore what are the different types.

What are the Different Types of BPO Automation?

It is important to understand the different types of BPO to make informed decisions about outsourcing.

- Robotic Process Automation (RPA): Software robots or bots mimic human actions to complete repetitive and rule-based tasks across applications and systems. RPA can automate various processes, such as data entry, transaction processing, and customer onboarding, without the need for human intervention.

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies enable us to automate tasks that demand understanding, decision-making, or learning from data patterns. AI and ML can be used for natural language processing, chatbots for customer service, document processing, and data analysis and insights.

- Intelligent Document Processing (IDP): A combination of AI technologies, such as Optical Character Recognition (OCR), computer vision, and natural language processing (NLP), to automate the extraction, processing, and management of data from various document formats.

- Cloud Computing: Cloud platforms provide the infrastructure and services needed to deploy and scale automation solutions flexibly and efficiently, allowing BPO providers to offer their services globally without significant upfront investments in IT infrastructure.

- Business Analytics and Data Analytics: These tools analyze data generated from automated processes to derive insights, improve decision-making, and optimize processes.

BPO automation offers a substantial opportunity for your business to increase productivity and growth, accompanied by a multitude of benefits. Let’s explore together what these advantages entail, but also a few drawbacks that you need to look out for.

What are the Benefits & Challenges of BPO Automation?

Benefits of BPO Automation

The decision to outsource business processes comes with lots of advantages. Let’s go through the main benefits of outsourcing.

- Cost Saving: According to a Deloitte study, the first reason why businesses outsource is cost saving. Studies vary, but companies typically save up to 50% by outsourcing back-office operations. Additionally, BPO providers invest in technology, sparing businesses from having to make such investments themselves.

- Focus on Core Tasks: Outsourcing enables businesses to concentrate on their primary objectives, ensuring better use of time and resources. In the Deloitte study, 57% of respondents claimed that this is one of the primary motivations for hiring a BPO service provider.

- Access to Expertise: Outsourcing offers access to a global talent pool and specialized skills without the overhead of training and maintaining an in-house team.

- Scalability and Flexibility: Outsourcing providers offer scalable operations, providing flexible people management. Due to tight labor markets and fixed contracts, flexibility is not always available. The Deloitte study reveals that nearly half of companies resolved capacity issues and gained flexibility through BPO.

- Enhance Efficiency and Innovation: Outsourcing with advanced tech drives innovation and keeps you ahead of competitors. Delegating tasks to specialized providers streamlines workflows, boosting efficiency.

Challenges of BPO

As we’ve seen BPO comes with lots of benefits. However, this service also comes with a couple of challenges.

- Loss of control: Outsourcing may pose management challenges, affecting control over tasks and the ability to enforce company standards or implement rapid changes.

- Security and privacy concerns: Outsourcing entails sharing sensitive company data externally, raising concerns about data breaches, mishandling, and regulatory compliance. It’s crucial to verify that the BPO provider implements robust security measures and adheres to relevant laws.

Business Processes You Can Outsource

BPO automation services allow you to outsource document processing tasks effortlessly by harnessing technologies like OCR and AI. Moreover, they ensure data accuracy through expert validation, providing an extra layer of verification.

Data Entry Outsourcing

Data entry, a labor-intensive task, involves manually inputting data from various sources into computer systems or databases, which consumes significant time. However, BPO automation streamlines this process by automating data entry. Leveraging OCR technology, it reads and extracts data before forwarding it to your system in your preferred format. Outsourcing data entry with a BPO provider significantly reduces processing time and costs while minimizing errors.

Document Verification Outsourcing

Document verification is an important step in customer onboarding, compliance checks, and fraud prevention. Traditionally, this process required manual review of documents such as IDs, passports, bank statements, and utility bills, which was time-consuming and prone to errors.

With BPO automation, businesses can deploy Intelligent Document Processing solutions that combine OCR with AI and Machine Learning to automatically verify the authenticity and accuracy of documents. These technologies can:

- Extract and validate information from various document formats and sources.

- Cross-reference data against external and internal databases for verification.

- Automatically flag discrepancies or suspicious documents for further review.

Outsourcing document verification not only speeds up the verification process but also enhances security and compliance with regulatory requirements with an automated document verification solution.

Real-Life Applications of BPO Automation in Various Industries

BPO providers assist different industries in executing various tasks such as identity verification, accounts payable processes, loyalty campaigns, and more. Let’s discover the first three examples below.

Accounts Payable

Accounts payable outsourcing transforms financial operations by automating and streamlining invoice processing, purchase order processing, invoice approvals, and payments.

Scenario: A global manufacturing company deals with thousands of invoices monthly from various suppliers and vendors. The manual processing of these invoices is not only labor-intensive but also leads to frequent errors, delayed payments, and strained supplier relationships.

BPO Solution: The company outsources its accounts payable process to a BPO provider equipped with a robust document processing solution to process invoices or purchase orders. The BPO provider leverages AI to automate data extraction and validation, followed by matching invoices with purchase orders and delivery receipts.

Outcome: Automating the accounts payable process results in a drastic reduction in processing time and operational costs. The company benefits from enhanced accuracy, improved supplier relationships due to timely payments, and better cash flow visibility.

Identity verification

Businesses can enhance their onboarding process by outsourcing identity verification. This allows them to leverage specialized technology and expertise, ensuring speed, accuracy, and compliance.

Scenario: A leading online banking institution faces challenges in managing the surge in customer sign-ups, needing efficient and accurate identity verification to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. The manual process is time-consuming and prone to errors, leading to customer dissatisfaction and potential regulatory fines.

BPO Solution: The bank partners with a BPO provider specializing in automated identity verification processes. They use advanced OCR (Optical Character Recognition) and AI (Artificial Intelligence) technologies to scan, extract, and verify customer official documents (ID cards, passports, or driving licenses) in real-time.

Outcome: The BPO provider’s document processing capabilities enable the bank to significantly reduce the time required for identity verification, from days to minutes, improving customer onboarding experience, satisfaction, and customer retention.

Additionally, the automated system enhances compliance with regulations, reduces the risk of fraud, and allows the bank to scale its operations efficiently without compromising on security or customer experience.

Loyalty programs

With BPO, businesses can outsource their loyalty programs. BPO services streamline receipt clearing by efficiently processing and validating data from customers’ documents.

Scenario: A retail chain struggles to maintain and analyze the vast amount of receipts and invoices generated by its loyalty program, making it challenging to accurately reward customer loyalty. The existing manual process is inefficient and fails to capture customer data, leading to errors and customer friction.

BPO Solution: The BPO provider offers advanced document processing tailored for loyalty programs. They implement a system to collect, process, and analyze receipts, invoices, or emails from customers. This data automation approach allows for the segmentation of customers and the creation of personalized offers and rewards.

Outcome: With the BPO provider’s expertise, the retailer significantly enhances its loyalty program’s effectiveness and leading to increased customer engagement, higher sales, and improved customer retention.

Now that you have all the keys in hand, keep on reading to find out how Klippa can assist you.

Outsource Your Document Processing with Klippa

At Klippa, we know how powerful automated outsourcing business processes can be. Choosing Klippa’s BPO services means partnering with a dedicated team focused on improving your efficiency, allowing you to focus on what’s important, saving you money, and driving your business forward.

Our specialized team, strategically located in the EU, combines human expertise with AI to accurately process all types of documents. Start using our ISO-certified services to simplify your document processing and ensure compliance within Europe.

If you’re curious to know more about the possibilities, please contact us or book a demo below.

FAQ

Traditional BPO relies heavily on manual labor, whereas BPO automation uses technologies like Robotic Process Automation (RPA), Artificial Intelligence (AI), and Intelligent Document Processing (IDP) to complete repetitive tasks faster, more accurately, and at scale.

With Klippa, automation is combined with expert human review, ensuring compliance and quality standards.

BPO automation benefits businesses of all sizes. Small companies can access advanced technology without large upfront investments, while large enterprises profit from scalability and efficiency gains.

Klippa offers flexible API and workflow integration suited for both ends of the spectrum.

Security depends on the provider’s compliance measures. Strong providers use encryption, secure data centers, and adhere to frameworks like GDPR or ISO 27001.

Klippa’s EU-based operations ensure data is stored and processed under strict European privacy laws, with auditable processes for full transparency.

Common candidates include:

– Finance & Accounting: invoice and purchase order processing.

– Customer Onboarding: ID verification and KYC checks.

– Back-office: data entry, document classification, and validation.

Klippa’s specialization lies in document-heavy workflows across multiple industries, like financial, logistics, and manufacturing.

Key indicators include:

– Reduction in processing time.

– Decrease in error rates.

– Increased throughput without added headcount.

Example: Klippa’s clients, like Label A, often report processing times cut from days to minutes, with error rates reduced by 90–95%.

Implementation can range from a few days to several weeks, depending on process complexity. With Klippa’s flexible API and ready-to-use workflows, basic automation setups can go live in under 2 weeks, while enterprise-scale integrations may take longer.

Klippa’s modular architecture allows easy adaptation to new document formats, languages, and compliance requirements. Cloud-based infrastructure ensures global scalability without large capital investment.

Not entirely. Automation reduces repetitive, error-prone tasks, but human expertise is still critical for complex verification, judgment-based decisions, and customer interaction. Klippa’s approach intentionally blends AI efficiency with human oversight.