Fraud threatens businesses and organizations in almost every industry. These frauds range from identity fraud to financial fraud and pose a risk to the overall strength and integrity of a business. Therefore, getting in front of this fraud is an important step for businesses today.

In the United Kingdom for example, in 2023, Experian found that identity fraud for example increased by 22% in 2023 compared to 2022. As only one example of the prevalence of fraud, this illustrates the importance of proper document verification protecting businesses and organizations from fraudulent activities.

In this blog, we will take a closer look at document verification, explain how it works, and some industries that can benefit from incorporating document verification in their day-to-day document processing needs.

What is Document Verification?

Document verification is a process that enables individuals and businesses to ensure the authenticity and reliability of submitted documents. It is integral to various application processes requiring identity authentication and information validation.

Document verification techniques are employed by businesses and institutions to ensure that documents such as identity documents, financial documents, and healthcare records are authentic and valid. With accurate document verification, businesses can verify customers, vendors, employees and so much more.

There are two primary methods of document verification: manual and automated. Businesses often choose between these options based on their specific needs and preferences. Automated document verification, often considered the superior of the two, utilizes technologies like AI to verify documents faster in scale and with lower error rates.

Types of Document Verification

Manual Verification: Manual verification involves human review and validation of documents, relying on visual inspection and manual document checks. This may work for businesses that only need to verify a few documents a week for example but is prone to errors, time-consuming, and is not suitable for high-volume scenarios.

Automated Document Verification: Automated document verification utilizes Optical Character Recognition (OCR) along with AI and machine learning to swiftly and accurately extract and authenticate data from a variety of documents, including passports, driver’s licenses, and bank statements. This is often achieved using rule-based techniques, NFC checks, smart data matching algorithms, and other sophisticated methods.

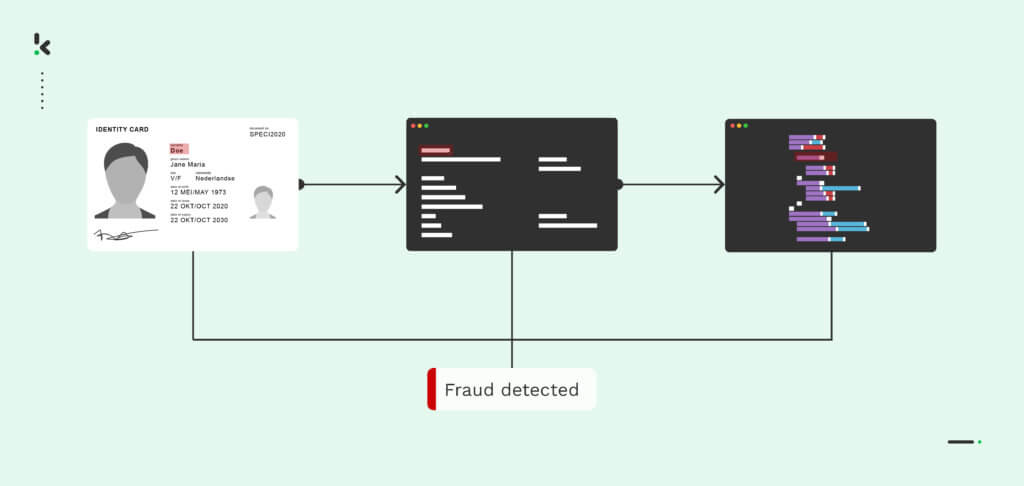

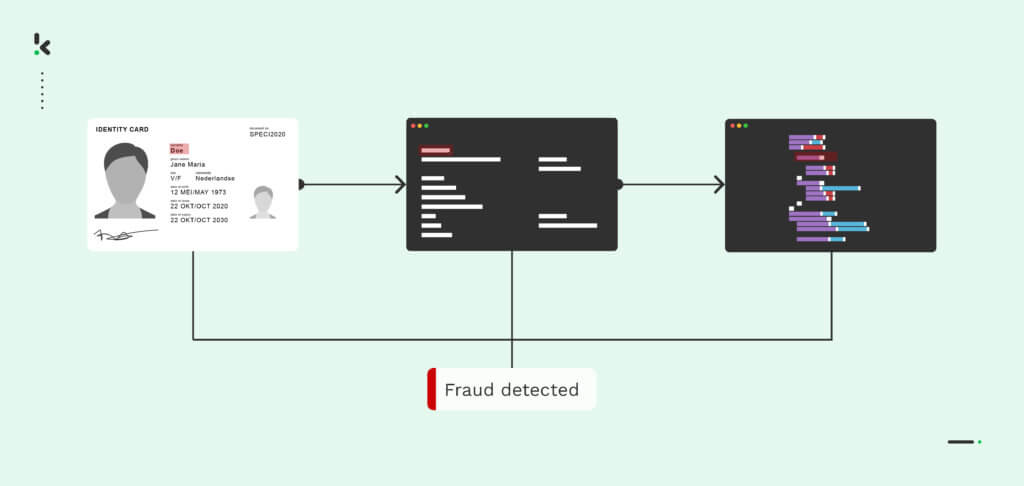

How Does Document Verification Work?

Now that we have established the types of verification there are, let’s go into detail about how exactly automated document verification works. Here are the steps.

Document submission

The first step in verifying a document is to collect and submit the document. Many mobile applications often provide users with the ability to submit their documents in-app while receiving real-time user feedback. This ensures a high image quality for the data extraction phase of the document verification process.

Data capture

At this stage, after the user has uploaded their document, it is ready for data capture. Using Optical Character Recognition (OCR), the document verification system turns the image of the document into text making it easier for the document to be processed for validation.

Data extraction

The data extraction is made possible with the help of OCR and AI technologies, allowing all relevant data to be extracted from the document. Using AI algorithms, the document verification software can examine the context and structure of the document to properly process and classify the document further in the process.

Data fields including names of the document holder, issue and expiry dates dates, nationalities and more can be extracted. After the extraction, this data is converted into machine-readable data such as JSON, CSV, XLSX, and XML making it easier to search and retrieve when needed.

Document validation

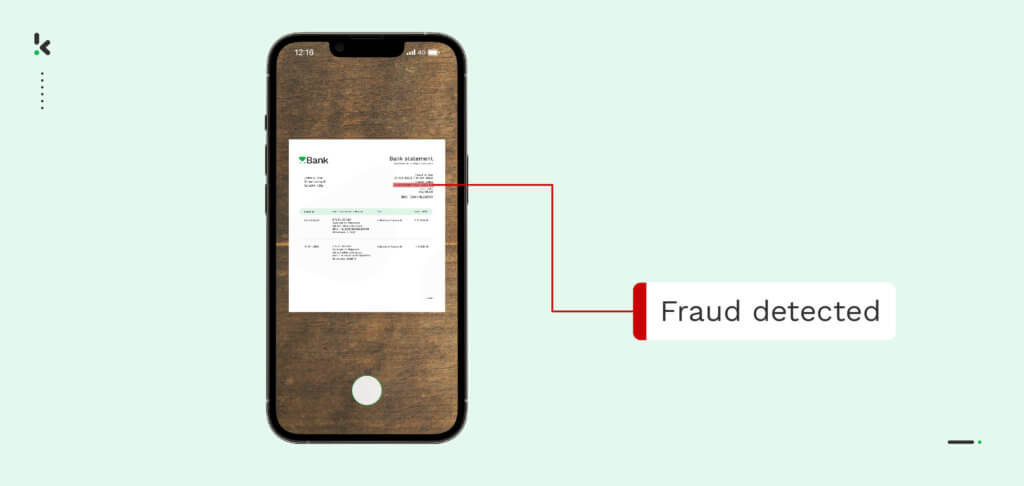

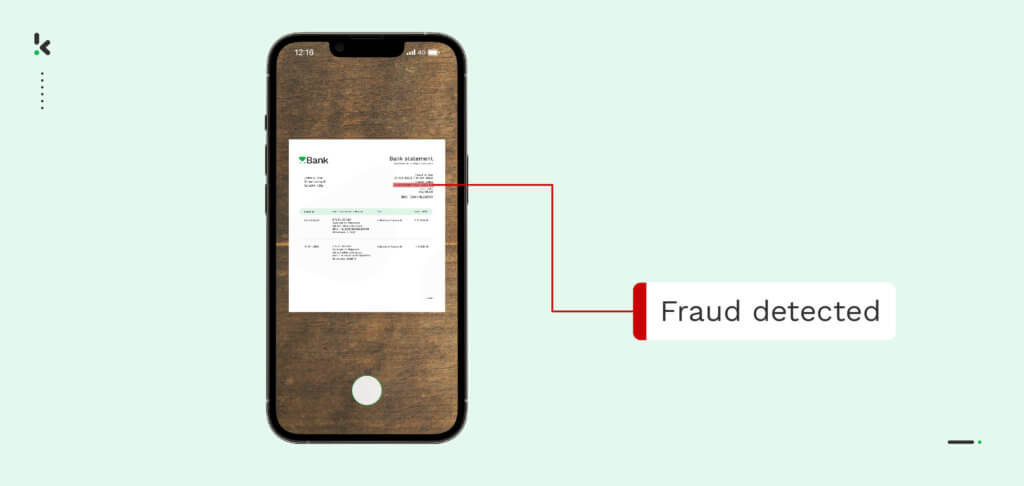

Once all the data has been extracted, the data can be verified. At this stage, the document verification system checks the submitted document for signs of manipulation. It checks for signs of fraud, and security features to validate the information against trusted sources and ensure that it meets the required standards of the verification process.

Some other common validation checks include:

- EXIF data analysis: Checking the Exchangeable Image File Format (EXIF) information embedded within digital files to authenticate document origins, dates and time of creation, and Photoshop activity to check whether the image has been altered.

- Grayscale analysis: When a photo is submitted, the document verification software can analyze the color composition of the document focusing on the grayscale or black-and-white composition of the photo. This helps identify potential fraud and photo manipulation.

- Special feature identification: Some documents include security features, for example, watermarks, kinegrams, NFC, holograms, and more. These features are often difficult to replicate and their presence or absence can be indicative of a document’s authenticity.

- Cross-check validation: Documents can include information that is easily cross-verified. Cross-check validation involves comparing information extracted from the document against external databases or trusted sources.

- Completeness checks: Many document types have a standard format and should always include several sections and details. With completeness checks, you can verify whether all expected components or elements within a document are present. This includes scrutinizing key fields, signatures, or required sections.

Now, the document verification process can vary on a case-by-case basis. We have just laid out an example AI-powered software can be used for document verification purposes. In the next section, we will discuss some of the common use cases for document verification.

What Are Common Document Verification Use Cases?

Document verification finds diverse applications across industries, enhancing processes and mitigating risks. Here are the five most common use cases:

- Proof of Address Verification: Online Trading platforms and marketplaces for example can use document verification to ensure the eligibility of their traders from listing products or profiles on their platforms.

- Invoice Processing: Businesses can automate invoice processing, using document verification to enable 2-way matching and purchase order matching. With this, they can easily streamline accounts payable processes.

- Digital Onboarding (Customer / Employee): Companies use document verification to facilitate seamless digital onboarding, verifying customer identities and identity documents for both customers and employees.

- Age Verification: Online platforms and age-restricted services can utilize document verification to confirm the age eligibility of users, ensuring legal compliance.

- Proof of Income Verification: Banking and financial institutions can use document verification in the loan application process for example to ensure that customers have the means to repay loans. In addition, accurate proof of income verification can help businesses maintain regulatory compliance.

In all these scenarios, the versatility of document verification in safeguarding processes, enhancing efficiency, and ensuring the integrity of information across various sectors is clear.

Benefits of Using AI for Document Verification

The benefits of document verification are undeniable and vary from industry to industry. In this section, we will go into some of the benefits of AI-powered software for document checks.

- Regulatory compliance: AI-powered document verification can help businesses comply with industry regulations including HIPAA, KYC & AML, and GDPR compliance.

- Fraud Prevention: AI-powered document verification is beneficial for fraud detection purposes. AI-powered document verification can be used to spot fake bank statements, spot fake IDs, invoice fraud, and mortgage fraud.

- Reduced Turnaround Time: With automated document verification, businesses can benefit from reduced reliance on manual tasks like checking documents or onboarding customers and employees. Repetitive tasks can be completed quicker and more efficiently reducing turnaround time.

- Save Money: With AI-powered document verification, businesses can spend less money on hiring people to perform mundane tasks, mitigate losses on human-made manual errors, and save money overall.

These benefits are clear and undeniable and can be enjoyed by businesses across a wide range of industries some of which include financial services, healthcare, logistics, and retail. There is a range of intelligent document processing solutions like Klippa DocHorizon that bring document verification to your very hands keeping your business safer from fraud.

Document Verification with DocHorizon

With Klippa DocHorizon, you can easily verify document a wide range of documents including passports, ID cards, driver’s licenses, receipts, invoices, and bank statements. Klippa’s solution allows you to enhance accuracy and efficiency while protecting your business from fraudulent actors and enhancing compliance.

Additionally, Klippa DocHorizon allows you to convert, classify, and automate document processing workflows in your organization. With our platform, for example, you can easily implement Human-in-the-loop verification for additional human checks for certain types of documents.

Curious to find out how Klippa’s document verification solution can help? Book a free online demo below or contact one of our experts for more information!