Frauds such as identity theft are on the rise, making Know Your Customer (KYC) processes more critical than ever to prevent fraud and ensure compliance with Anti-Money Laundering (AML) regulations. To achieve this, organizations are turning to advanced solutions like identity verification software, which helps confirm that customers are who they claim to be during the onboarding process.

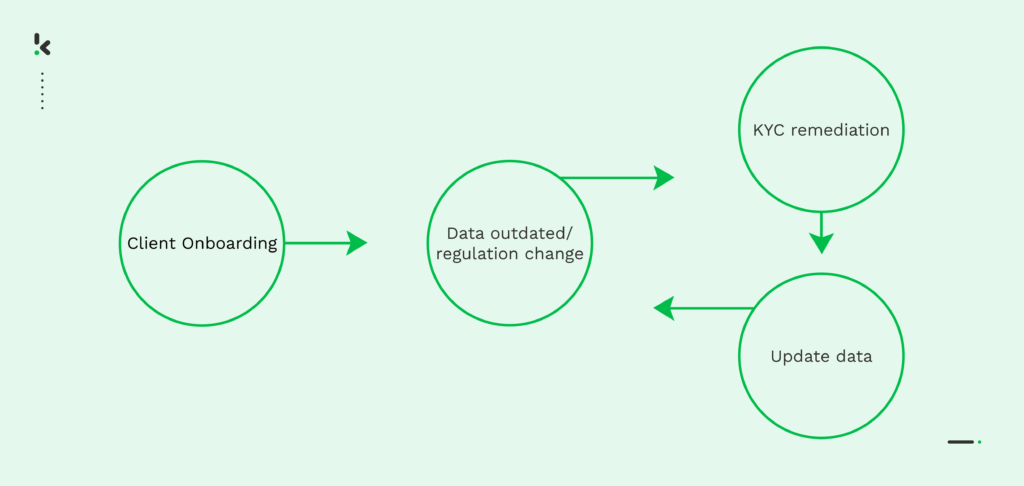

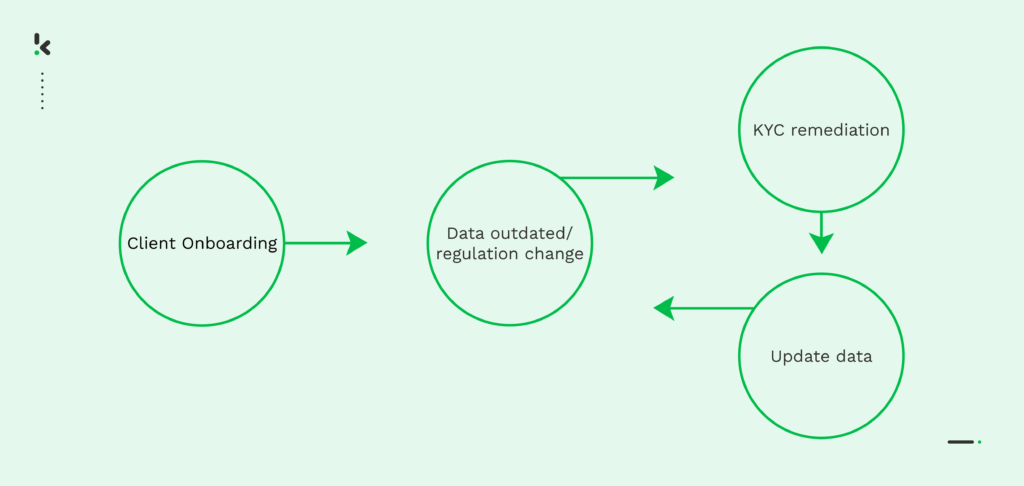

However, as time passes, customer data, regulations for data storage, and AML requirements change. This asks for a new and different approach to receiving and updating data as an extension to the KYC process, which is also known as KYC remediation.

In this article, we’ll explore how organizations can implement an effective, customizable KYC remediation process to meet compliance needs efficiently. By the end, you’ll have the insights needed to stay compliant with ease.

What is KYC remediation?

KYC remediation is the process of keeping customer data accurate, up-to-date, and compliant with current regulations. It involves reviewing, updating, and cleaning the customer information collected during the KYC process, such as ID documents or proof of address.

This process is crucial for adapting to changing regulatory requirements and reassessing customer risk levels based on Anti-Money Laundering (AML) standards. By ensuring the integrity of customer data, KYC remediation helps organizations stay compliant and reduces the risks associated with outdated or inaccurate information.

Why is KYC remediation important?

The importance of KYC remediation is based on many factors. Your organization must ensure that the information you hold on your customers is accurate, relevant, and up-to-date. But keep in mind that the main reason to perform KYC remediation is to remain compliant with KYC and AML regulations.

Let’s have a look at the key points to highlight the value of executing such a verification.

KYC and AML regulations are constantly evolving

When regulations change, you may not know right away which of your clients should update their information or documents. For instance, some documents have to be updated every three months, such as Proof of Residence.

Companies not performing KYC remediation risk violating KYC and AML legislation and facing a severe fine. In 2020 alone, the number of fines imposed by AML Intelligence was more than 20 billion euros. Later in this article, we give advice on how to keep an eye on the regulations.

KYC and AML regulations are constantly evolving to keep pace with fraudsters and financial criminals. Governments or financial authorities update these regulations. By performing regular KYC remediation, you ensure that you remain in compliance with the latest regulations in your country and industry.

Outdated data represents a high risk to any organization

Keeping your customer’s outdated information can be a risk to your business because you will be working with irrelevant data. You may find yourself working with criminals or fraudsters without knowing it. Indeed, the lack of visibility on changes related to your client’s situation can be your weakness.

Given the fact that you are dealing with sensitive information, you also have to comply with GDPR. One of the GDPR articles states that companies have to delete the sensitive data of their clients when it is outdated or not used anymore. This is called the “right to be forgotten”. In short, if the data is outdated, it is no longer useful to you, so you can delete it.

Be as close to your customers’ needs as possible

It is important to be aware of changes in your clients’ lives, and whether these changes impact their ability to be part of your business. In addition, by having a better understanding of their lives, you can provide your clients with the best possible solution for their situation. For example, you can adapt your service offering based on your client’s new address. By staying close to your customers’ needs, you can provide them with better service and therefore build a trusting relationship.

All of these reasons show you the importance of performing a KYC remediation process: keeping an eye on changes, the risks that outdated data can represent, and staying close to your customers’ needs. Because it can be tedious to go through your clientele list, some parts of the KYC remediation can be automated. To do this effectively, you need a simple and efficient process, which we will cover next.

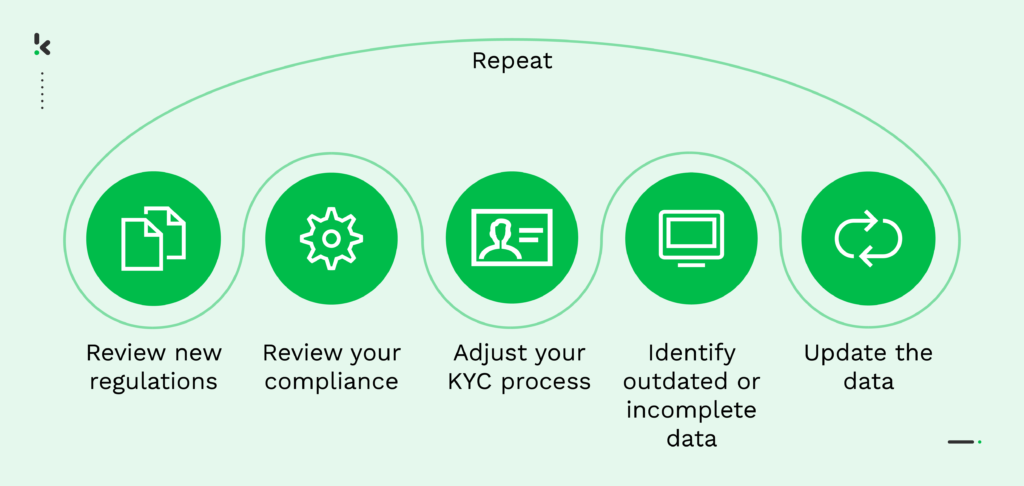

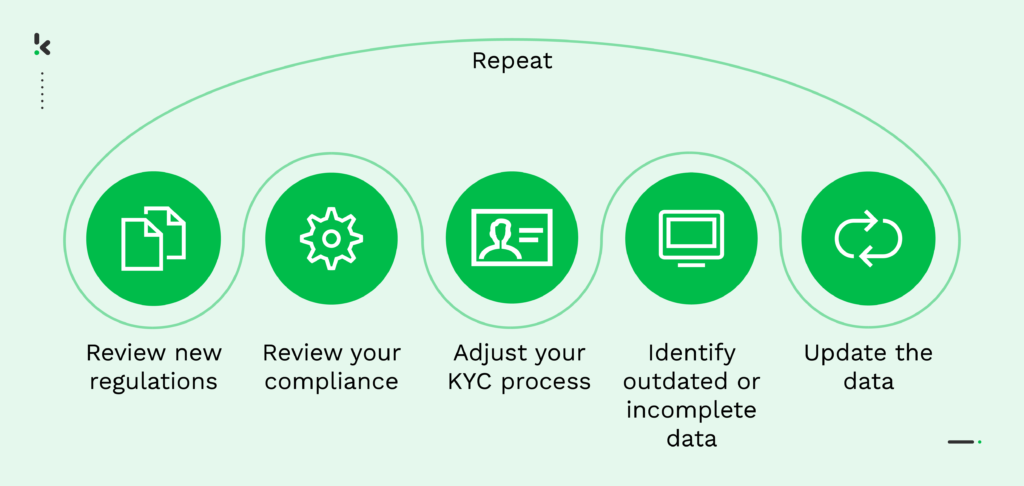

Steps in the KYC remediation process

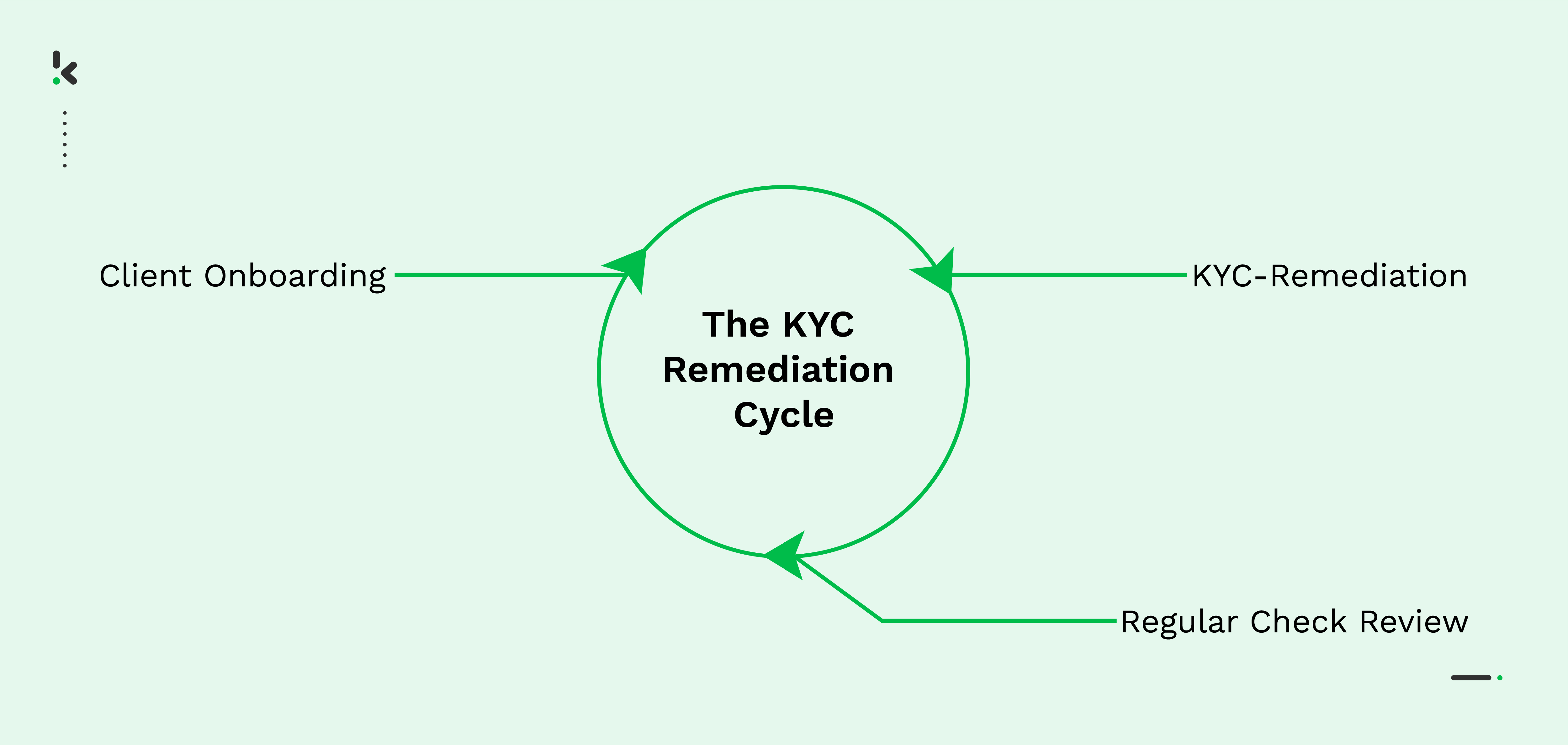

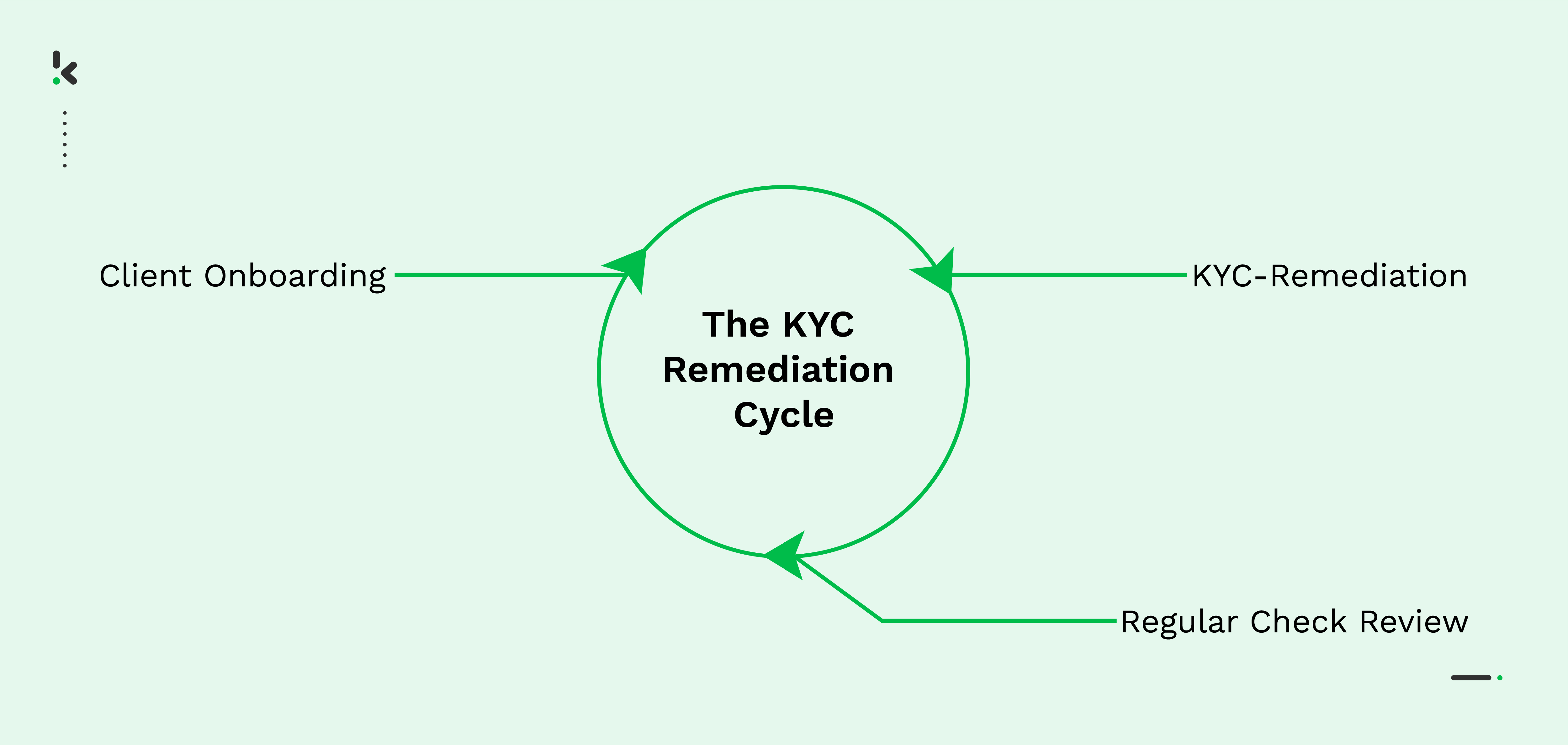

In a way, KYC remediation can be seen as an extension of the client onboarding process, since you’ll go through your clients’ documents and establish what is missing and where.

There are several steps that need to be performed systematically to ensure compliance. Some are time-consuming when done manually. Fortunately, today’s technology allows some of these steps to be performed automatically.

Let’s see the steps taken during the KYC remediation process which can be automated.

Step 1: Review new regulations

KYC and AML regulations change over time to keep up with fraudsters. For instance, regulations are updated to prevent fraud such as identity theft, document forgery, etc. This is why the first step in the KYC remediation process is to look at the new AML or KYC regulations and requirements in your country of operations.

As a matter of fact, in Europe during the past three years, more than 5 new regulations have been introduced. If you are not closely following the changes, you won’t be able to apply them. As a result, you won’t be compliant anymore and possibly face fines and an increased risk of security breaches.

Step 2: Review your compliance

Once you are aware of the changes, you must ensure that you are still in compliance with the new rules. Is your organization already compliant? Is there any new documentation required from your customer that you need to ask? Is there a change in the way sensitive information has to be stored?

Keeping track of the changes in regulations will help you adjust your processes to ensure your compliance with KYC and AML regulations.

Step 3: Adjust your KYC process to comply with current regulations

Now you can start adjusting your KYC process. To keep your organization compliant with the new changes, you need to implement them as soon as you can.

Track and update the different ways you used to do KYC onboarding. Adjust and apply the different ways of doing KYC remediation.

In the meantime, you’re probably onboarding new customers. You can do this in accordance with the new regulations.

Step 4: Check for outdated and missing data

How often do you check whether your customers’ data are up-to-date? Probably not often enough. People move in and out, documents expire, or more generally their lives change, and therefore their data too. This is why the data you obtained from your customers a year ago may not be accurate anymore.

With regulations changing, you may need more information from clients you didn’t ask during their onboarding. Or, you may even have to delete some information because it is not required anymore.

Working with outdated or missing data is a risk you have to take seriously. It can lead to an offer that is no longer suited for the customer’s current situation or to a client changing from one level of risk to another.

Step 5: Reach out to clients to get missing information

By performing KYC remediation, you may notice that you are lacking certain documents or information from your customers. Reach out to them and get all the needed information. For instance, this could be a more recent proof of residence as required by a new regulation.

Once this is done, your information and database are up-to-date and closer to the actual situation of the customer base.

Step 6: Repeat

The steps previously outlined are to be repeated for each customer and according to their risk level timeline. It is highly recommended to assign each risk level a specific timeline for review. General key risk indicators are the location of the customer, the customer type (an individual or a company), the size and amount of the transaction, and how it was made (cash or through a bank account). From there, you can evaluate the level of risk.

For instance, most companies work as follows:

- Low AML risk requires a KYC remediation every 24 to 36 months.

- Medium level of risk asks for a review every 12 to 24 months.

- For a high level of risk, count 6 to 12 months.

New regulations can also mean a way of attributing the level of risks. When onboarding a client, you assign them a level of risk they can represent regarding AML. You can now reevaluate the level of risk of every client you have based on the AML and KYC regulatory updates.

The manual remediation process would require your employees and CDD officers to use a significant amount of time to ensure that data is up to date. That would include asking your clients to submit documents, verifying the documents, entering data into the database, and updating the client profile.

This is a time-consuming process, which you must repeat for each customer every time their data is outdated or the validity of provided information is expired.

Luckily there are ways for companies to automate some steps of the KYC remediation process. The next sections present the benefits of this automation and introduce you to a fitting solution provider.

How to automate your KYC remediation process

With modern technologies and accessibility to various software, you can automate some parts of the KYC remediation process.

For instance, there is no longer a need for your employees to send out emails manually to the clients when they need to submit documents to update their information. There are plenty of email automation tools that can automate that for you by setting up the rules. For example, you can set up a rule that an email reminder is sent to customers 1 month before the identity document expires.

Similarly, you can eliminate manual data entry and document verification with the right OCR software such as Klippa DocHorizon. There is no longer a need to spend countless hours going through emails, downloading the documents received from customers, reading the documents, verifying the validity, and entering the required information into the database. As these are the tasks that can cause major bottlenecks in your KYC remediation process, we will dive more in detail into how DocHorizon can help you automate them.

Automatically update and sort client information

Klippa DocHorizon is an AI-embedded software that uses OCR technology to turn an image or document into structured text. With the software, you are able to extract the information received from your clients in the form of a picture, email, or document automatically.

Once the information is extracted and turned into machine-readable text, the software can be configured to automatically deliver that information into your database. The connection between the software and your database can be established via API.

The software is also able to detect document fraud with EXIF data analysis. This adds an extra security layer when dealing with numerous documents and minimizes the risk of accepting and processing forged documents.

With that being said, all documents received from your clients can be digitized and the software can even sort or label the documents based on their characteristics with AI.

By using DocHorizon you can eliminate manual data entry and automate parts of your KYC remediation workflow. And why would you do that? Take a look at the benefits below.

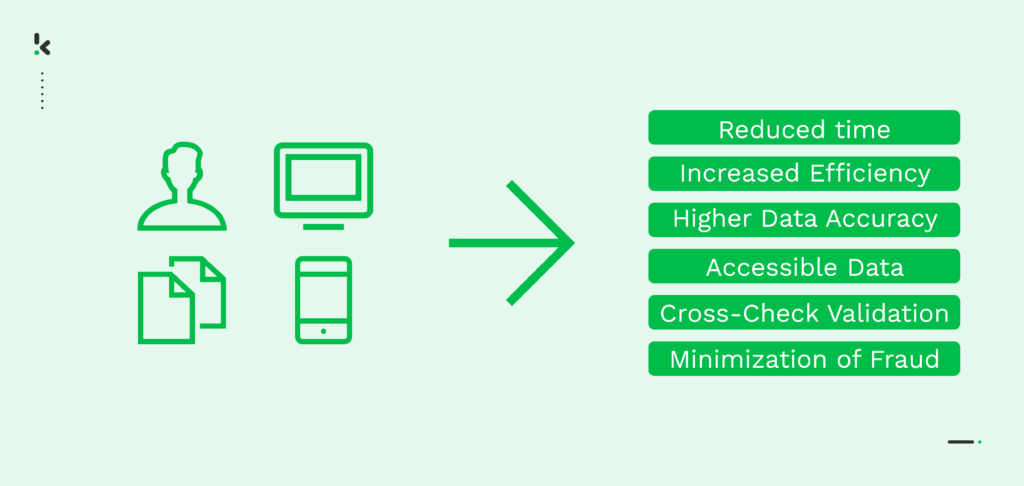

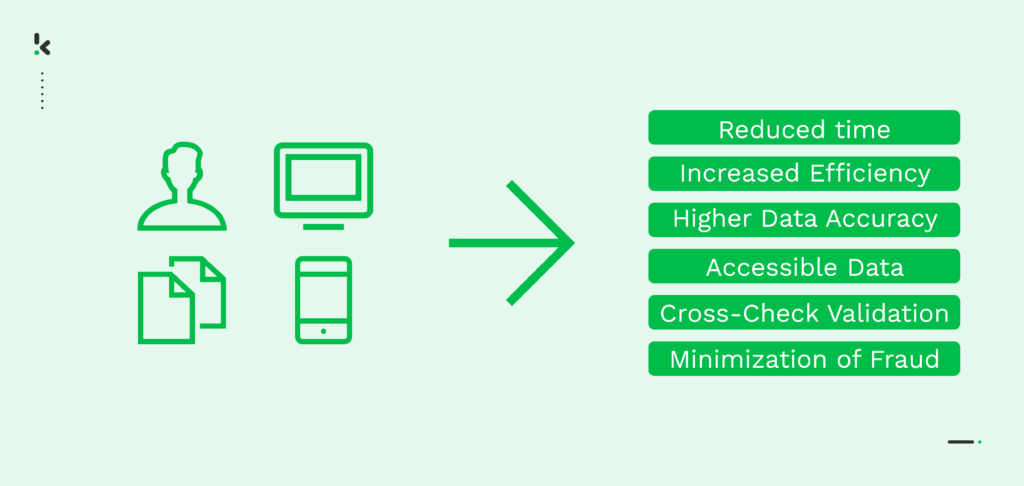

The benefits of automated KYC remediation

By automating some steps of your KYC remediation, you can expect the following benefits for your organization.

- Reduce time and increase scalability: instead of having your employees do a manual task, they can focus more on core tasks essential to your business. It also requires less time for the software to process documents than for an employee.

- Increase efficiency with an automated way of collecting and verifying customers’ documents. Manual data entry and document processing are not efficient and are too time-consuming. Instead, you can automate data entry by having documents scanned and extracted within seconds with OCR software.

- Higher data accuracy through data extraction software ensures you deal with accurate data from your customers in your database.

- Keep your database up-to-date and searchable, which gives easy access to your database for regular checks and updates.

- Cross-checks with third-party databases can also be automatically executed, allowing you to validate information about your clients.

- Lower the risks of fraud by spotting altered or fraudulent documents with document fraud detection.

Simplify your KYC remediation process with Klippa

The obligation to comply with AML and KYC regulations can be a real pressure on organizations. Each new update on those regulations can lead to a modification of your KYC process and can change the list and documents required from your clients.

We already introduced you to the importance of automating the KYC remediation process. You just read about all the benefits you can expect from it.

It is now time for you to find the right KYC remediation solution provider to help you automate some of the steps mentioned above. You can start your journey to automation and reap the benefits with Klippa DocHorizon, which can be customized according to your needs.

Want to reduce time, ensure compliance, and minimize fraud? All you need to do is contact our specialists to get more information, ask for a quotation, or schedule a free online demo with the form below!

FAQ

The KYC remediation process involves reviewing, updating, and validating customer data to ensure it is accurate and compliant with the latest regulatory requirements.

While the regular KYC process focuses on onboarding and verifying new customers, KYC remediation deals with maintaining and updating existing customer data to reflect current regulations and risk profiles.

KYC remediation should be conducted periodically or when regulatory requirements change, customer data becomes outdated, or a reassessment of a customer’s risk profile is necessary.

The main steps include reviewing existing customer data, identifying outdated or missing information, updating and validating data, and ensuring it aligns with current AML and regulatory standards.

Businesses can streamline KYC remediation by leveraging automation tools like AI and OCR to quickly review, update, and validate customer data, reducing manual effort and ensuring compliance efficiently.