Imagine the potential chaos when outdated or incorrect customer information leads to regulatory non-compliance or, worse, fraud. The data you relied on yesterday could be obsolete today, putting your business at significant risk.

With regulations tightening and fraudsters growing more sophisticated, sticking with outdated verification methods is time-consuming, risking compliance penalties and security breaches. It’s a scenario no business can afford. Therefore reverification is a crucial part of your customer management.

If you’re wondering when customer reverification needs to be done, and what it entails, you’re at the right place! Let’s get started!

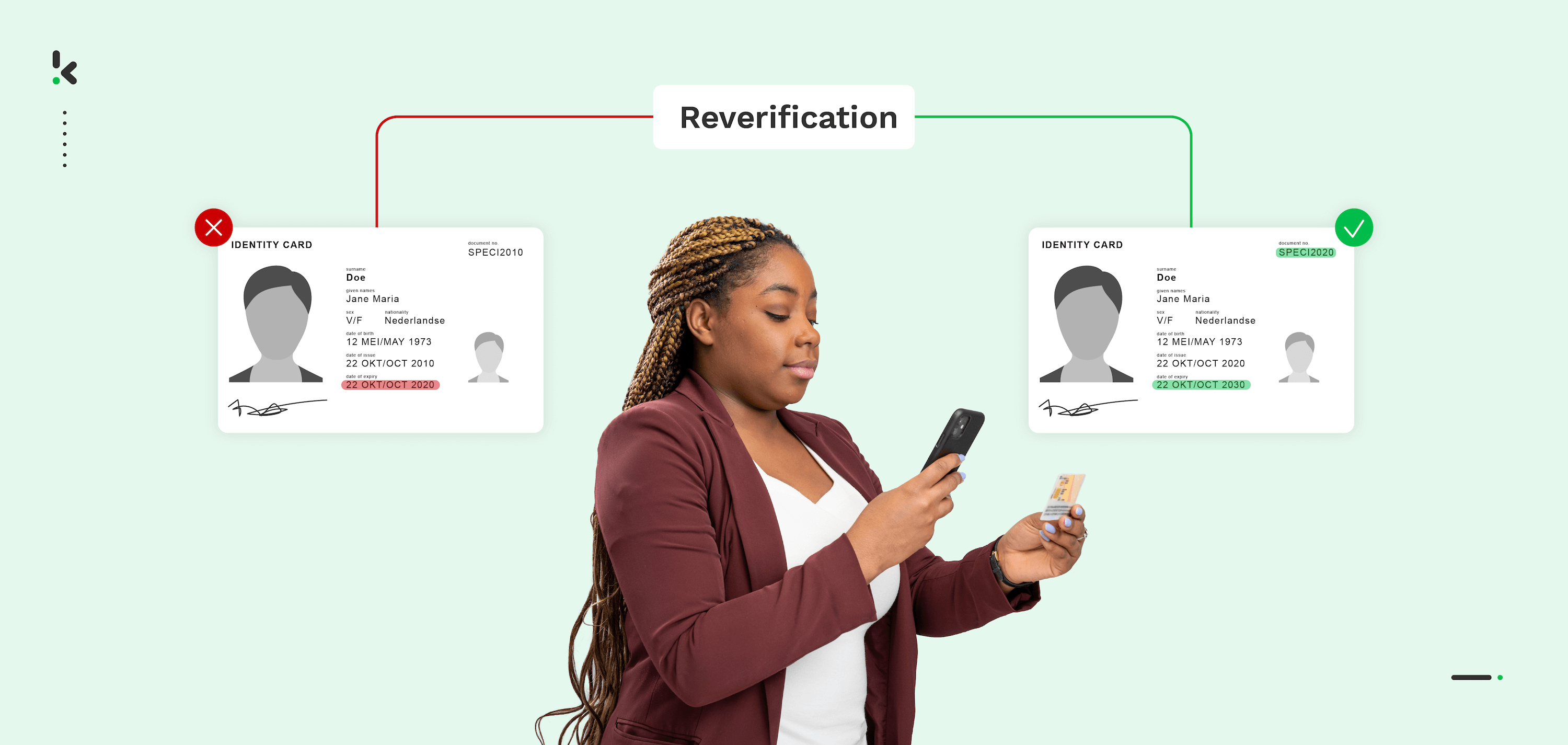

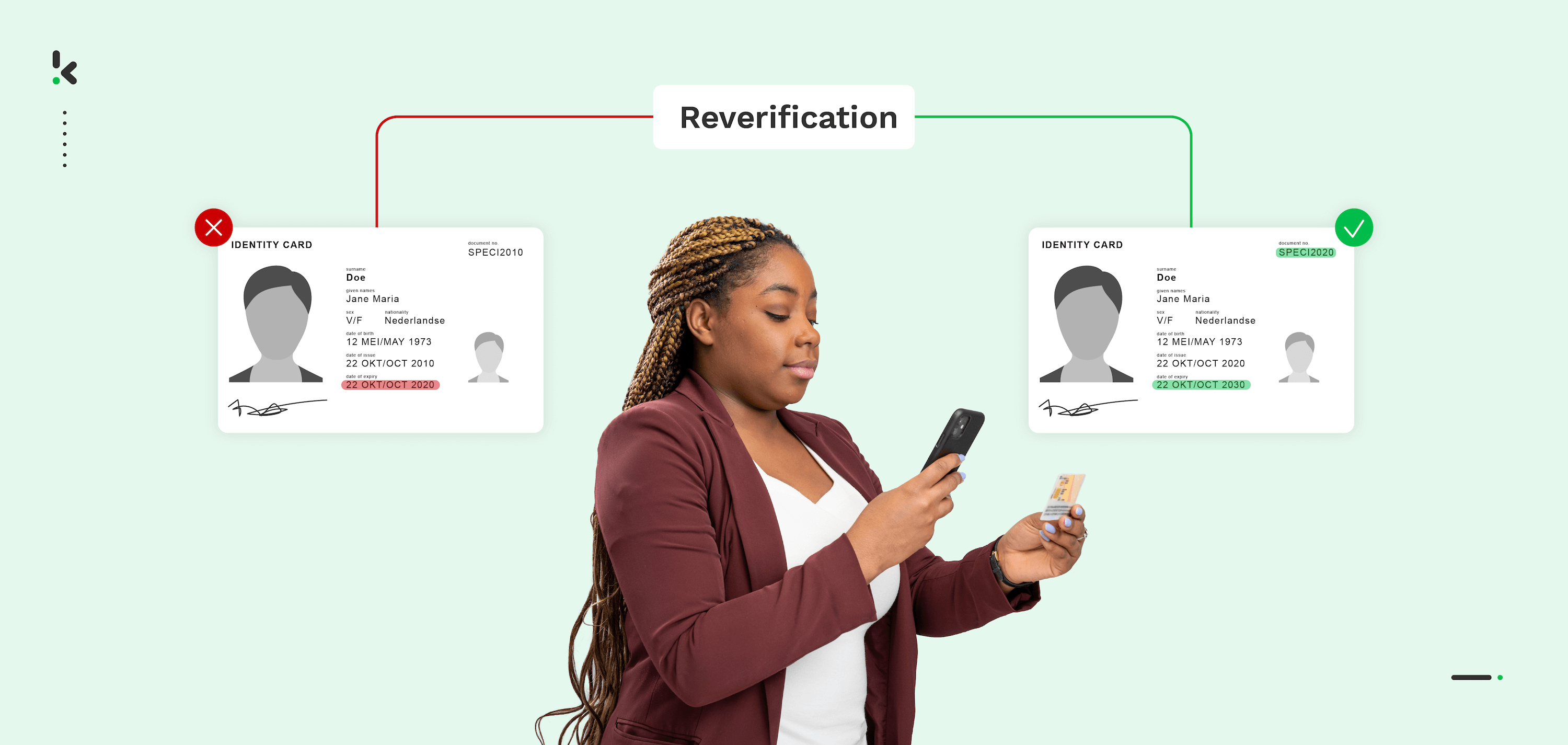

What is Reverification?

Reverification involves the process of verifying the identity of your current customers once again. This is done to ensure that all the information you have is accurate, thus enhancing compliance with your industry rules.

Unlike the initial customer verification, which takes place at the beginning of the customer journey, reverification occurs periodically or is triggered by specific events that we’ll discover later in this blog.

Why is Reverification important?

Regularly verifying customer data isn’t only a best practice—it’s a legal obligation to adhere to global regulations combating money laundering, fraud, and other financial crimes.

Take KYC, for example. It’s not a one-time verification; continuous KYC processes ensure you’re consistently informed about your customers, thereby shielding you against identity fraud. The same principle applies to compliance measures like AML and CDD.

Frequent reverification assists in spotting questionable activities and revising risk profiles based on up-to-date customer data, ensuring strong security to safeguard customer information from fraudsters which is in line with the GDPR. The importance of reverification lies in the following key elements.

Fraud Prevention

- Detect anomalies: Catch irregularities in customer data, averting potential fraud with regular reverification.

- Preventing Unauthorized Access: Stop unauthorized access and prevent financial losses with up-to-date records.

- Reducing Financial Losses: Timely identify fraudulent activities to prevent significant damage.

Maintaining Accurate Customer Records

- Enhanced Communication: Reach out to customers more effectively, fostering better communication and engagement when updating customer information.

- Improved Customer Experience: Enable personalized experiences and informed decision-making with accurate customer data.

Risk Management

- Preventing Compliance Issues: Enhance compliance, avoiding penalties and legal issues especially in financial services.

- Addressing Security Risks: Be proactive in addressing risks, such as exposure to data breaches or unauthorized access by ensuring that sensitive data is accurate and up-to-date.

- Mitigating Operational Risks: Get rid of inaccurate or outdated customer records that can lead to operational inefficiencies, such as failed deliveries, billing errors, or communication issues.

The benefits of customer reverification are numerous to safeguard your business against fraud and penalties. Now, let’s discover together when reverifying your customers’ identities should be done.

When Should You Reverify Customer’s Identities?

Customer reverification becomes mandatory in specific situations, each signaling a potential need to update their information to ensure ongoing compliance and security. These situations include:

- Document Expiry: Identification documents, like passports or driver’s licenses, have an expiry date. Reverification ensures that the records are up-to-date.

- Significant Transactions: Unusual transactions that differ from a customer’s typical activity pattern may trigger a need for reverification to rule out money laundering or fraud.

- Updated Regulatory Requirements: New compliance requirements may demand additional information from current customers to ensure compliance with new laws.

- Changes in Customer Information: Events like a change in marital status, address, or legal name require updates to a customer’s profile to keep records accurate and relevant.

It can be overwhelming to have the reverification as an extra step in your customer’s management process. That’s where technology comes in place to make the reverification a breeze for you and your customers.

How Reverification Works

Reverification can be performed in various ways. In this section, we’ll go through the different options you have to complete your customer reverification.

Document verification

During document verification processes, customers are often required to provide new or updated documents to reverify their identity and personal information. These documents may change according to the information that needs to be updated:

- Government-issued IDs for any expired documents

- Utility bills, or salary slips to confirm the new address

- Legal documents such as a marriage certificate to prove any changes in names

However, this process can be challenging and time-consuming, especially when it comes to detecting fraudulent documents. Fortunately, technology can significantly help you.

By using Optical Character Recognition (OCR) and AI, the submitted documents are scanned and analyzed. OCR technology extracts text and data from the documents, while AI algorithms assess the authenticity and relevance of the information. This step significantly reduces the risk of manual errors and speeds up the verification process.

Biometric verification

By leveraging AI image recognition technology, biometric verification methods like selfie verification or liveness detection can be employed to enhance identity authentication. These methods compare biometric data with existing records, providing an extra layer of security.

- Selfie verification: Users are asked to take a selfie. This selfie will be compared with the ID documents already provided or the selfie already taken previously.

- Liveness detection: Users are required to perform random movements to ensure their physical presence during the reverification.

Behavior and Transaction Analysis

Businesses can analyze customer behavior and transaction habits for any irregularities or significant changes with AI. These changes might indicate a need for further investigation or additional verification steps.

After the information is updated, it can be cross-referenced against regulatory requirements. Any potential risk is assessed by checking against international databases for any sanctions, PEP status, or other red flags that may affect the customer’s risk profile.

Now that you know everything about customer reverification, let us introduce you to the solution that can streamline and strengthen this process for you.

Simplifying Customer Reverification with Klippa

Automated identity verification by Klippa simplifies customer reverification, enabling businesses to concentrate on growth while maintaining top security and compliance standards.

Klippa offers many features applicable to different use cases:

- Verify the authenticity of documents with document verification

- Add layers of security with NFC verification, selfie verification and liveness detection

- Detect fraud in seconds with automated fraud detection

- Anonymize private data to comply with GDPR

Curious to know more about how we can help you during your customer reverification processes? Please contact us, or book a demo below!