A study by the Association of Certified Fraud Examiners (ACFE) found that businesses lose an estimated 5% of their revenue annually to fraud, with invoice fraud being one of the most common schemes. This highlights the importance of verifying the accuracy of all received invoices before payment is made.

To verify the invoices, all details of the purchase (mentioned in the invoice) need to be matched with other documents (e.g., purchase order). This verification process is called two-way matching and can turn into a very tedious task when done manually.

But before we talk about how this process can be automated with the Klippa DopHorizon platform, we’ll discuss what 2-way matching is and how it works, so you can understand it better.

Ready?

Key Takeaways

- Two-way matching verifies invoice accuracy – Compares the invoice with the purchase order (PO) to ensure the details match before approval.

- Three-way and four-way matching offer additional security – Three-way adds a goods receipt note, and four-way includes a quality inspection, providing even more comprehensive verification.

- Automation improves accuracy and speed – Using OCR-based software, like Klippa Dochorizon, automates the matching process, reducing manual errors and saving time.

- Streamline workflows with automated solutions – DocHorizon helps integrate automated workflows, preventing errors and improving the efficiency of the invoice approval process.

What Is Two-Way Matching?

Two-way matching, also known as invoice matching, purchase order matching, or line item matching, is a process that checks for discrepancies between the invoice and the purchase order (PO), comparing specific details on both documents within the invoice processing function. Only once this step is completed is the invoice approved, paid, or denied.

If the two documents don’t align, the invoice is held without being paid until mistakes are addressed or corrected.

Generally, companies use two-way matching to reduce time spent on invoice verification, avoid the risk of human error, and ensure that invoice amounts are correct.

Now that we know what two-way matching is, let’s see how this process actually works.

How Does Two-Way Invoice Matching Work?

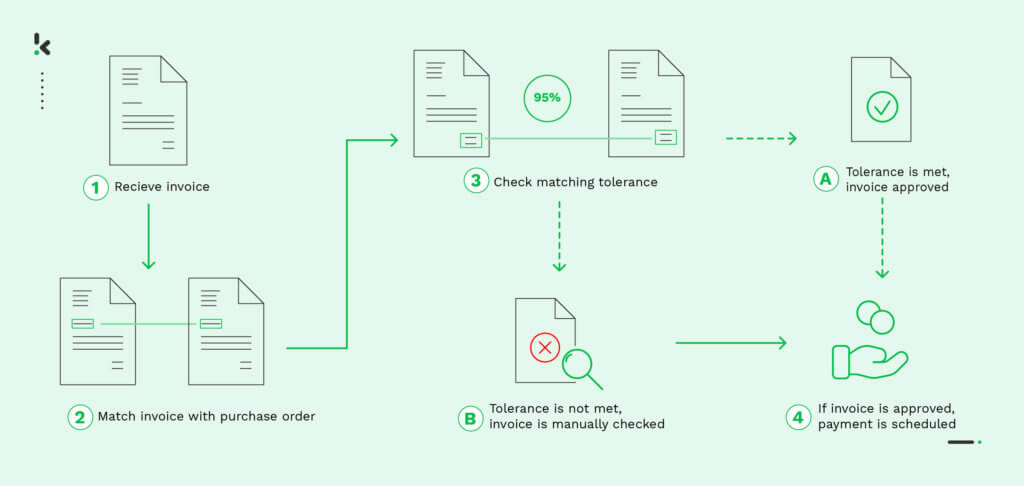

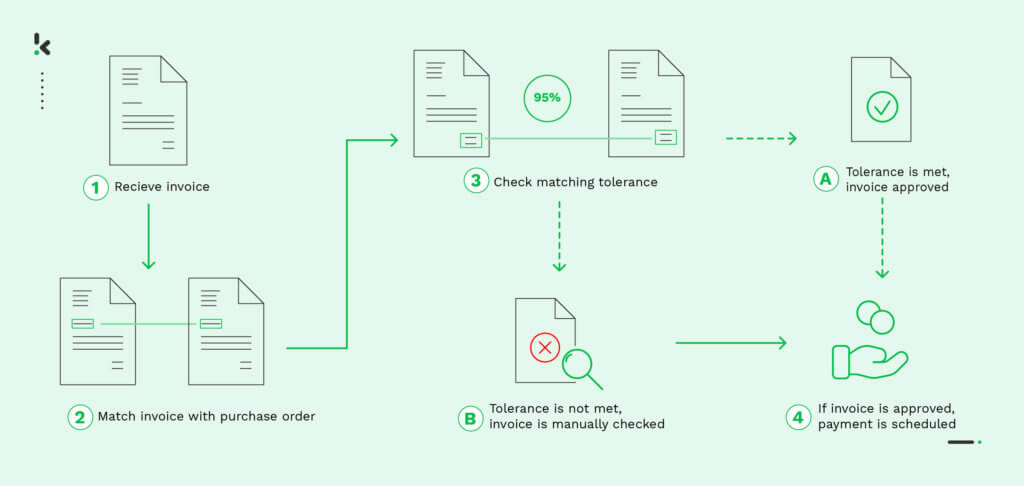

There are several steps an accountant has to go through in two-way matching. These steps look as follows:

Step 1: A company receives an invoice from a vendor for the goods/services ordered via the purchase order.

Step 2: The invoice is manually stored in the database of the receiving company and matched to the corresponding PO.

Step 3: How this step is executed is determined by the so-called tolerance. The tolerance values are set beforehand and decide the action to take when documents match (or do not). Two situations can occur:

- Situation 1: If the tolerance is met, the invoice is approved and paid.

- Situation 2: If the tolerance isn’t met and discrepancies between the invoice and the PO occur, the invoice is placed on hold. In this case, the invoice is not approved and paid. The accounts payable manager has to resolve the issue manually.

Step 4: Either the invoice is approved manually or is sent back to the invoice matching process for approval. Once the invoice is approved, the payment is scheduled, and the transaction between the company and the vendor is completed.

After reading this, you might think that this process cannot be done so easily for a high volume of documents, and wonder if there’s a better way to do it. Luckily, we know one!

Let’s see how easy it is to match automatically purchase orders and invoices using our platform.

How to Automatically Match Invoices with Purchase Orders?

Klippa’s Dochorizon IDP platform helps streamline the entire workflow involved in two-way and three-way matching, with customizable features. By leveraging AI-powered OCR, the platform ensures an accurate two-way matching and data extraction process.

For this example, we’ll extract data from purchase orders and invoices to verify if the details on both match one another. If they do, the files will be uploaded to Google Drive. If not, an email will be sent to the sender.

And the best part? You can try our platform for free!

Let’s see first-hand how two-way matching can be automated with Klippa’s IDP platform.

Step 1: Sign up for the platform

The first step is to create an account on our DocHorizon platform. Signing up is simple: just visit Klippa’s website, click the sign-up button, and provide some basic information such as your full name, company name, use case, and expected document volume.

After registering, you’ll receive €25 in free credits to explore the platform’s features and determine if Klippa DocHorizon fits your needs.

Next, set up your organization and create a project to start using the services.

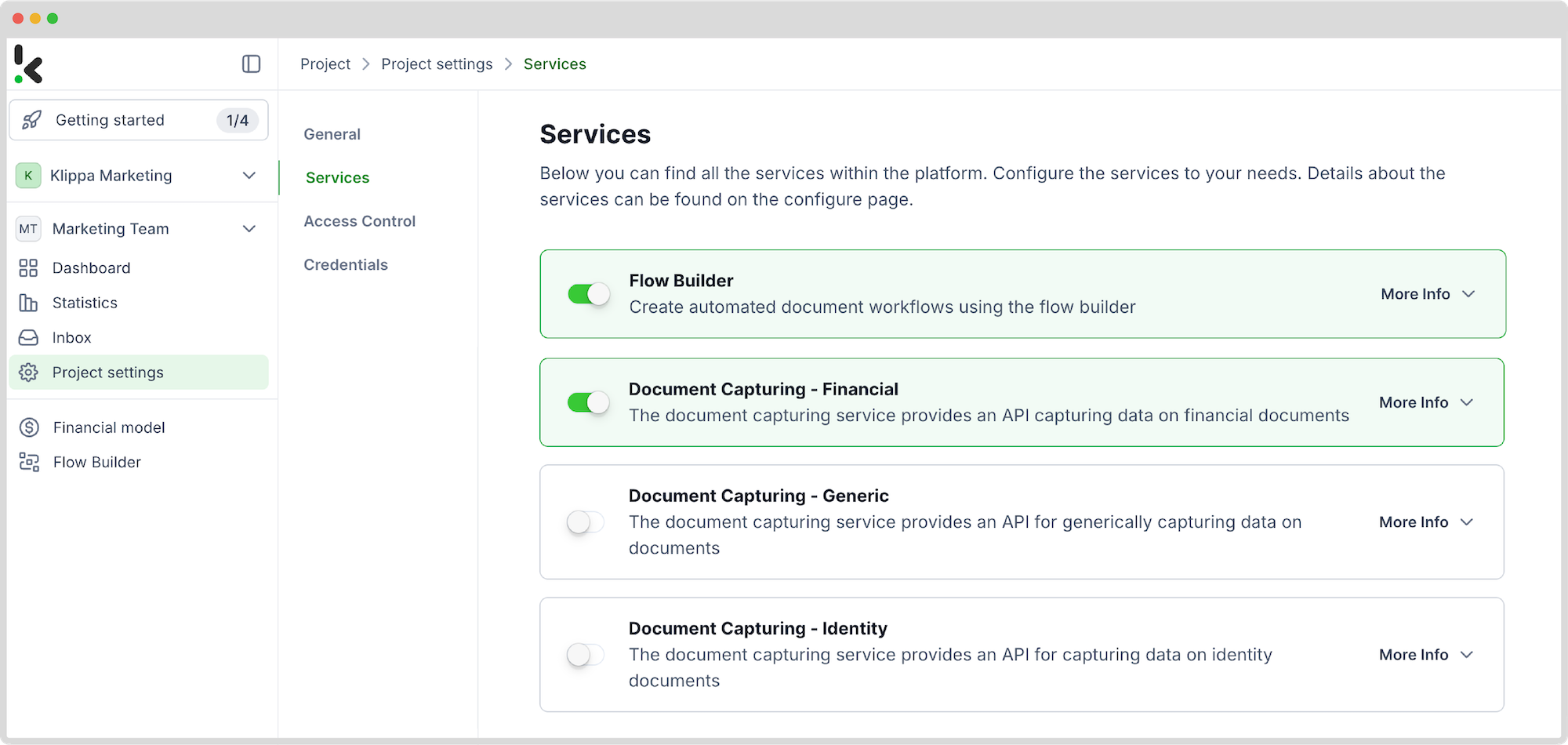

Now, you can select the Document Capturing – Financial Model and Flow Builder services, just as seen in the image below. And you are all set!

Step 2: Select the input source

In this step, you select the input source from which you retrieve your data. The most common way someone receives a purchase order and invoice is through the mail, and they are usually found as email attachments.

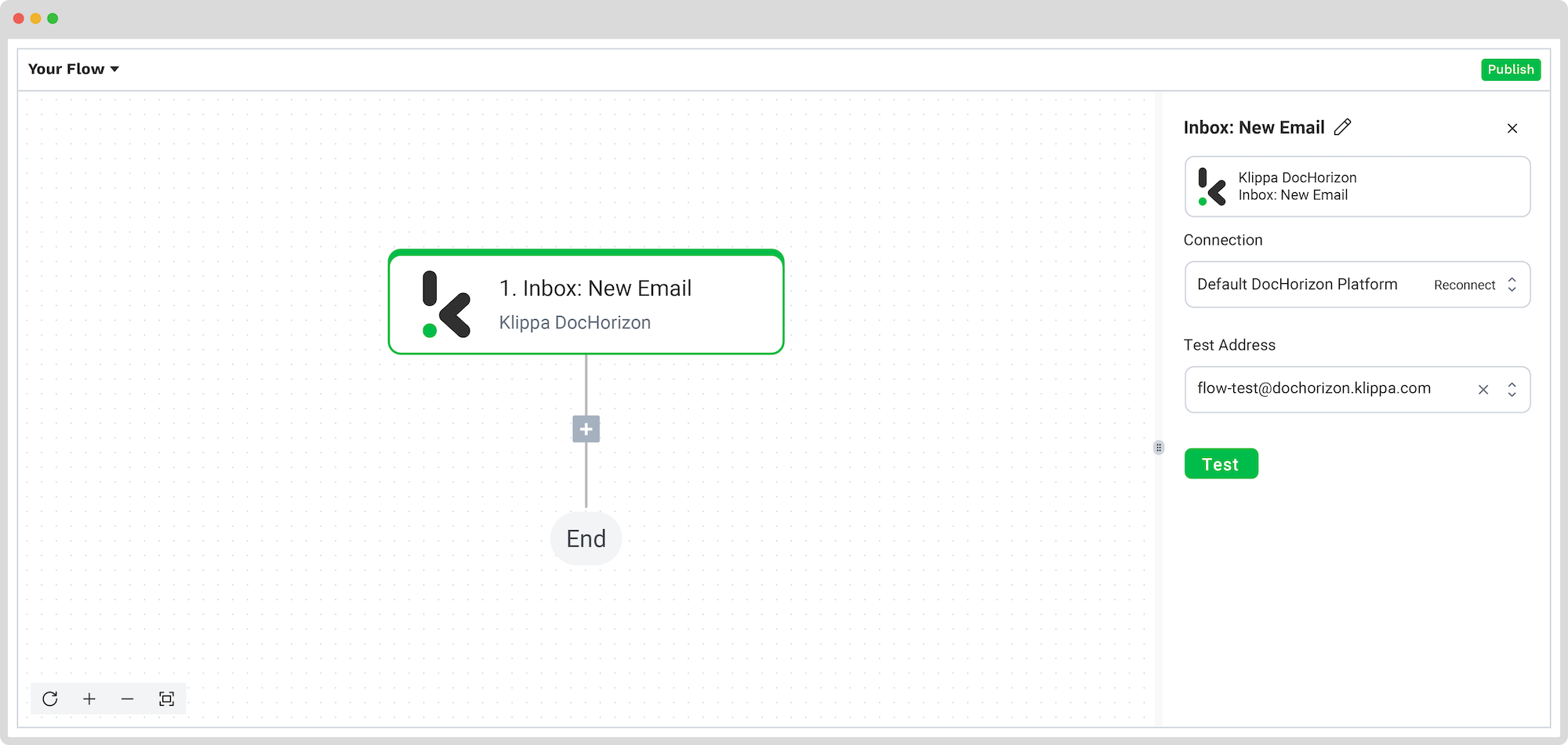

To do this, head over to the platform’s Flow Builder. On the left menu, select Flow Builder, then create a new flow by clicking New Flow -> + From scratch, and give your flow a name.

Inside the flow builder, choose your input source by clicking Select Trigger and search for Klippa DocHorizon -> Inbox: New Email. After, connect this step to the platform.

To test this step, simply send an email to the test address provided so you can generate sample data for the platform to work with. Remember to test all the following steps to ensure that the flow is working properly.

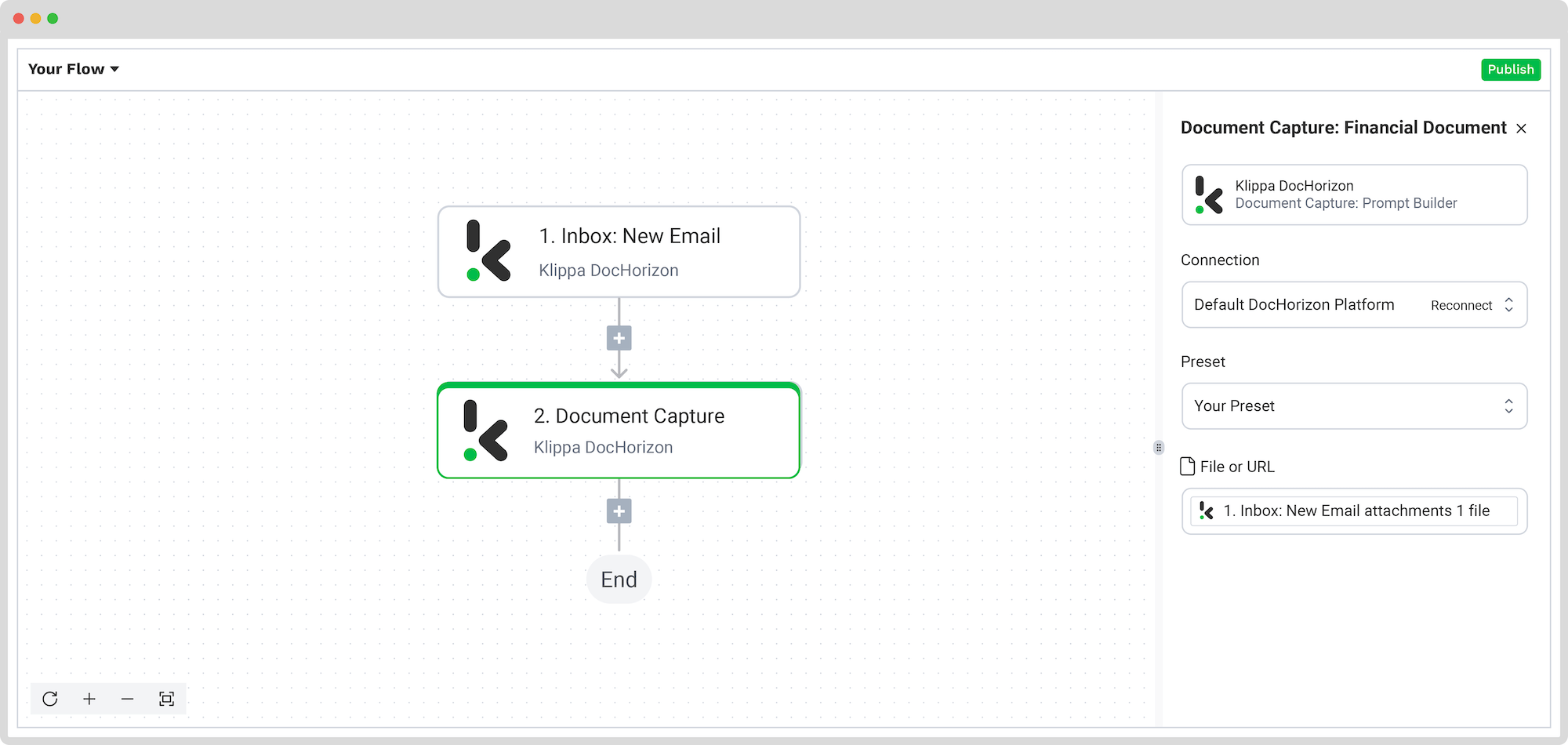

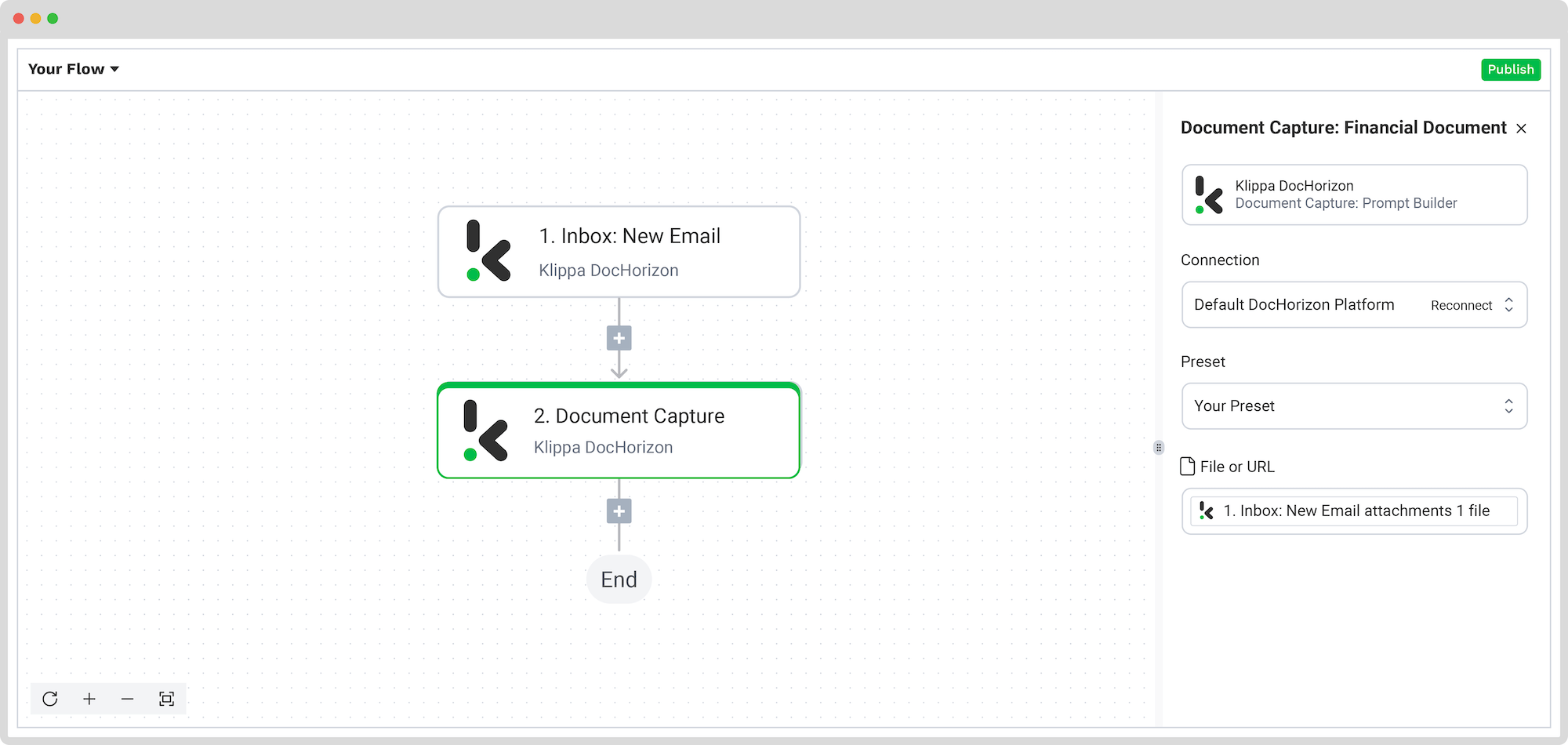

Step 3: Capture data from the first file

To extract all the necessary fields, select the document capture module as the second step. This is an important step as the platform needs data to do the two-way matching.

Since we’re dealing with two different files, data must be extracted from each one of them, separately.

Click on the + icon below the “Inbox: New Email” bubble and look for Document Capture: Financial Document. Next, please configure the following for the first file:

- For Connection: Create again a connection with the Default DocHorizon Platform

- For Preset: There’s no preset needed

For File or URL: Click on the box and pick from the menu Inbox: New Email attachments -> attachments -> attachments 1 -> file.

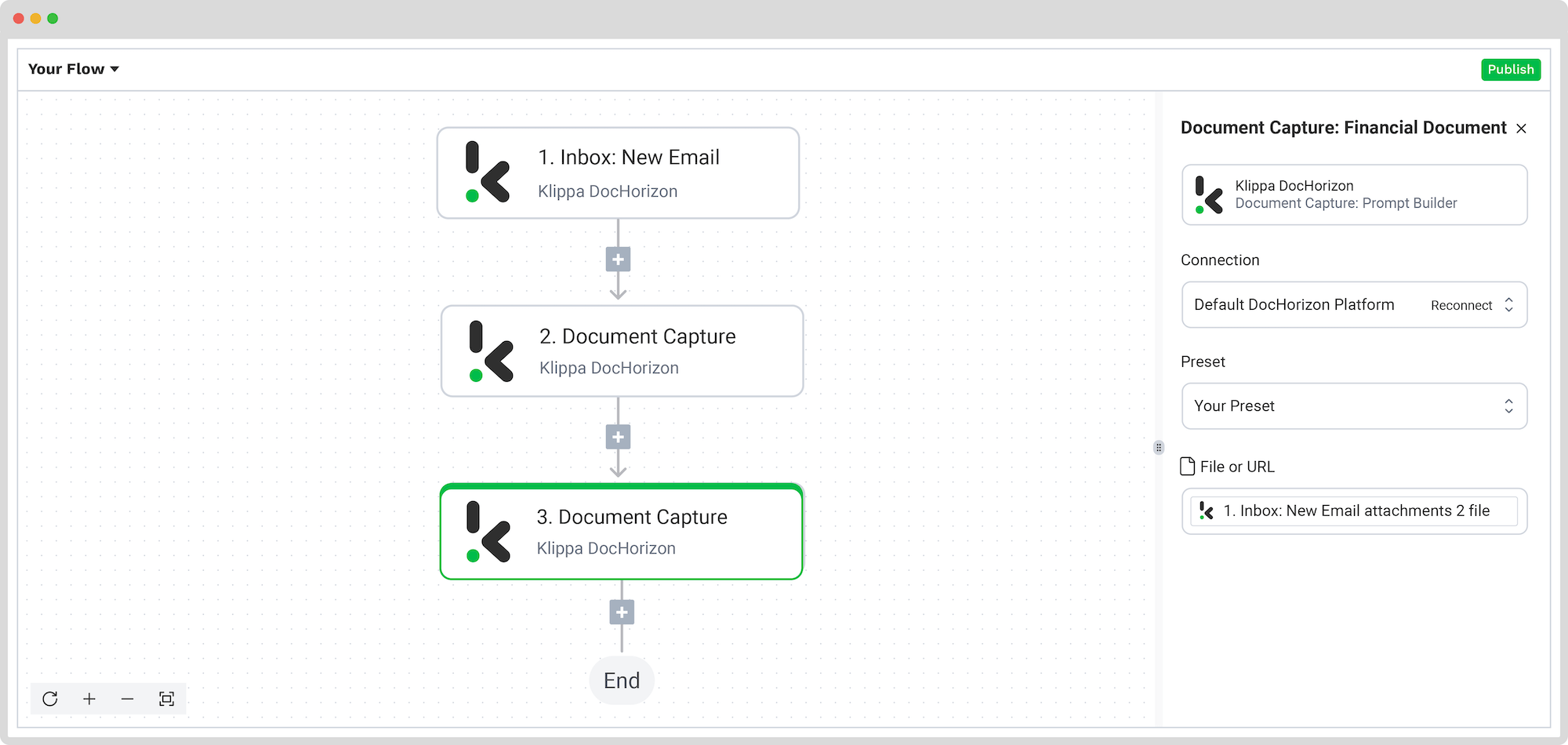

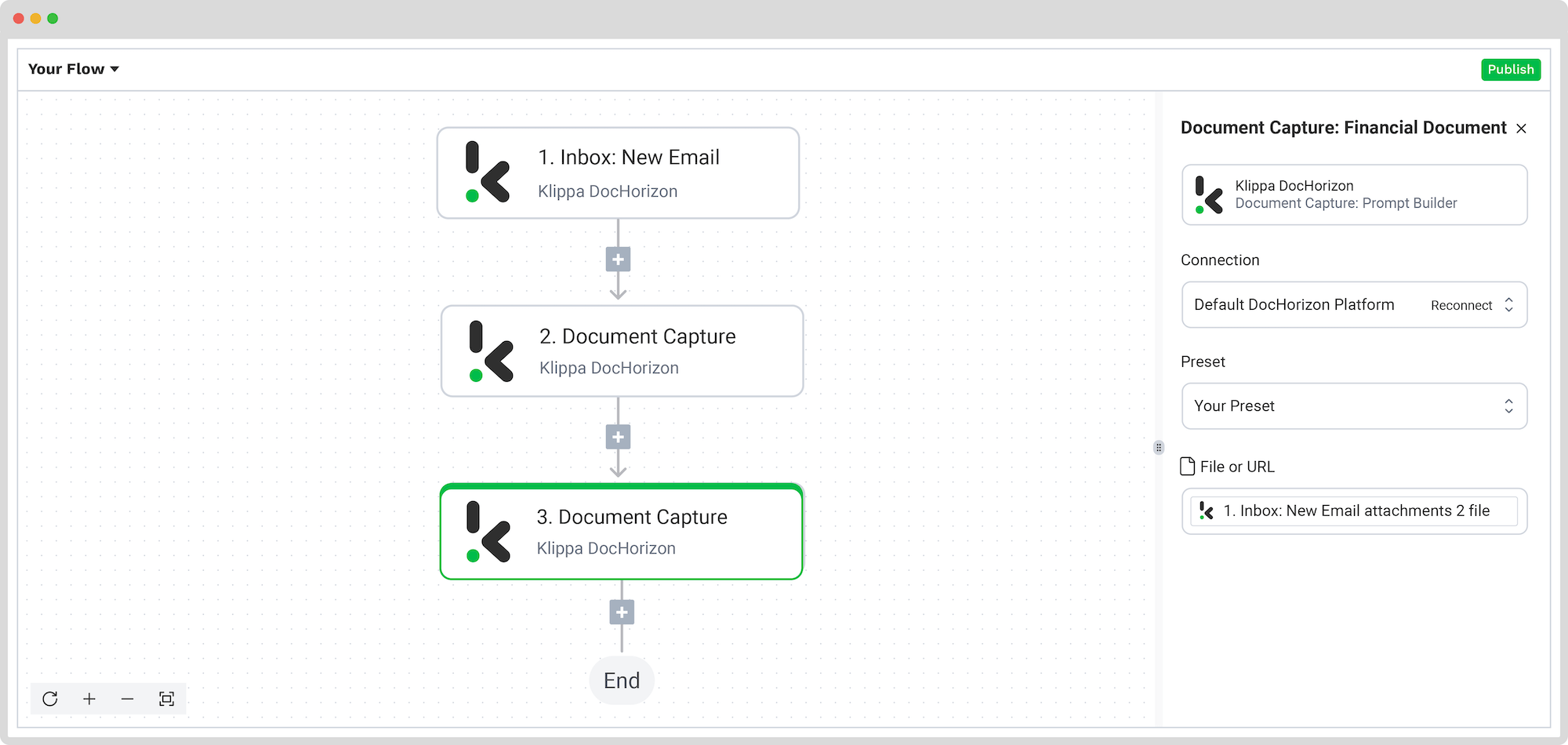

Step 4: Capture data from the second file

This step is a replica of the previous step. The only difference is that, for the configuration of the File or URL box, you select now from the menu Inbox: New Email attachments -> attachments -> attachments 2 -> file.

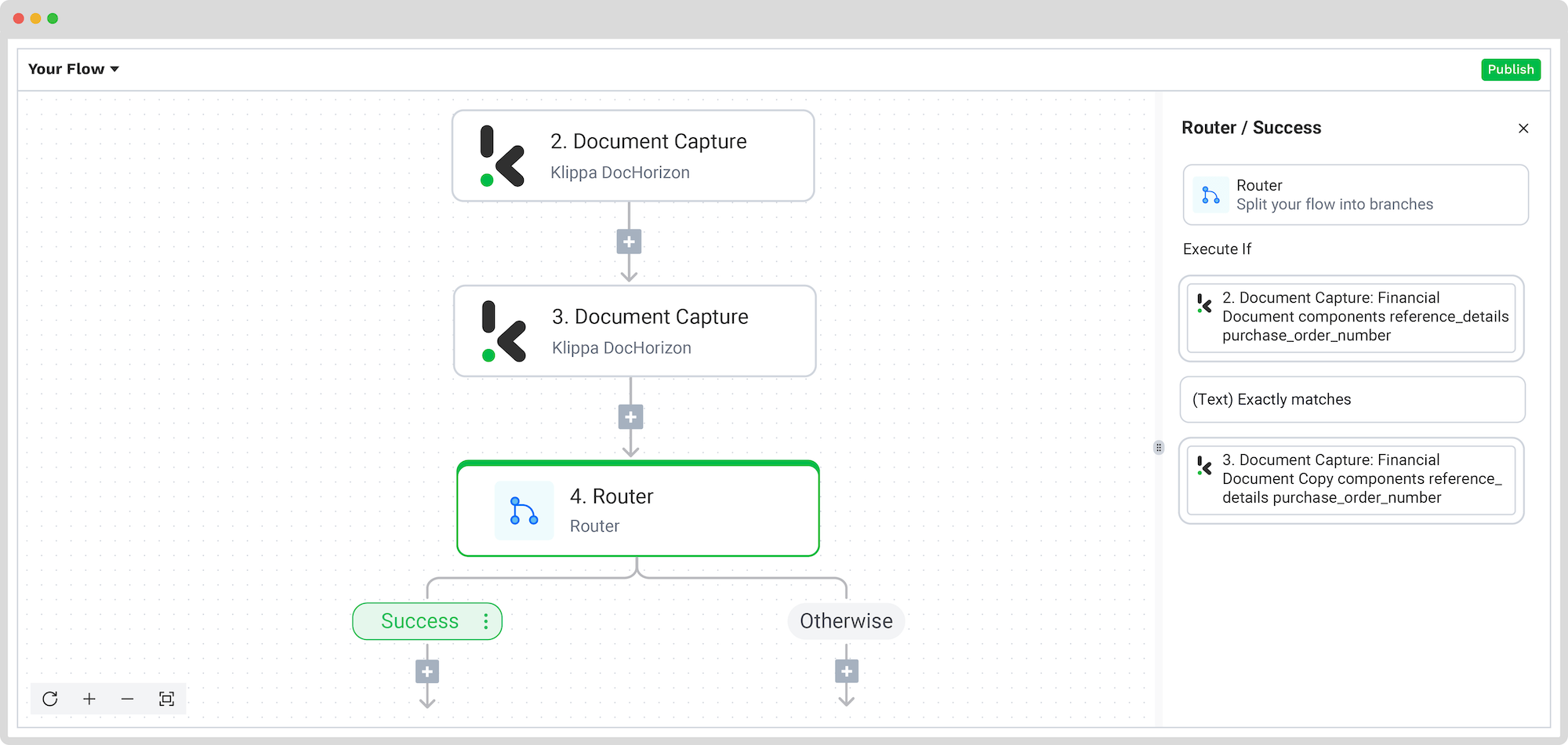

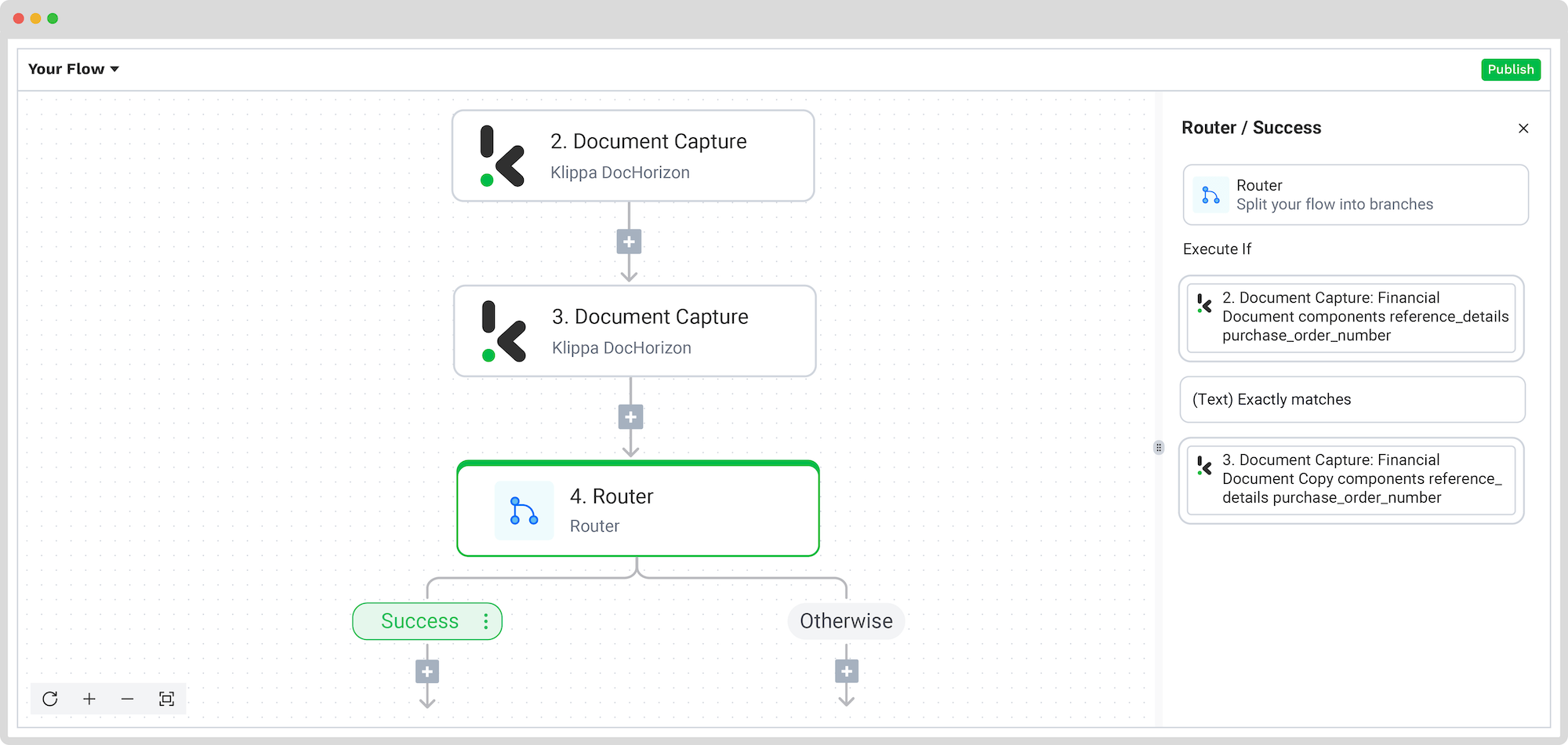

Step 5: Create a conditional routing

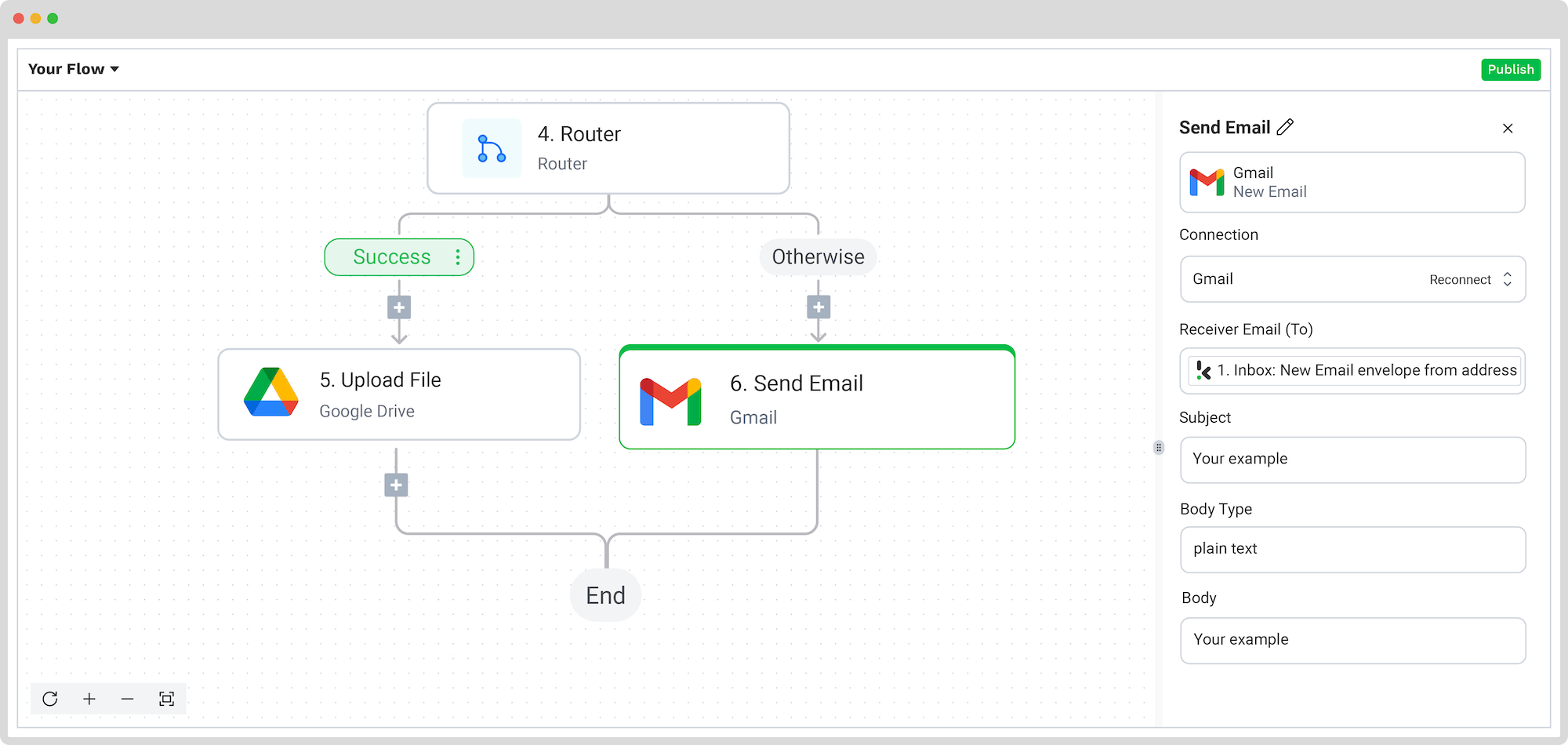

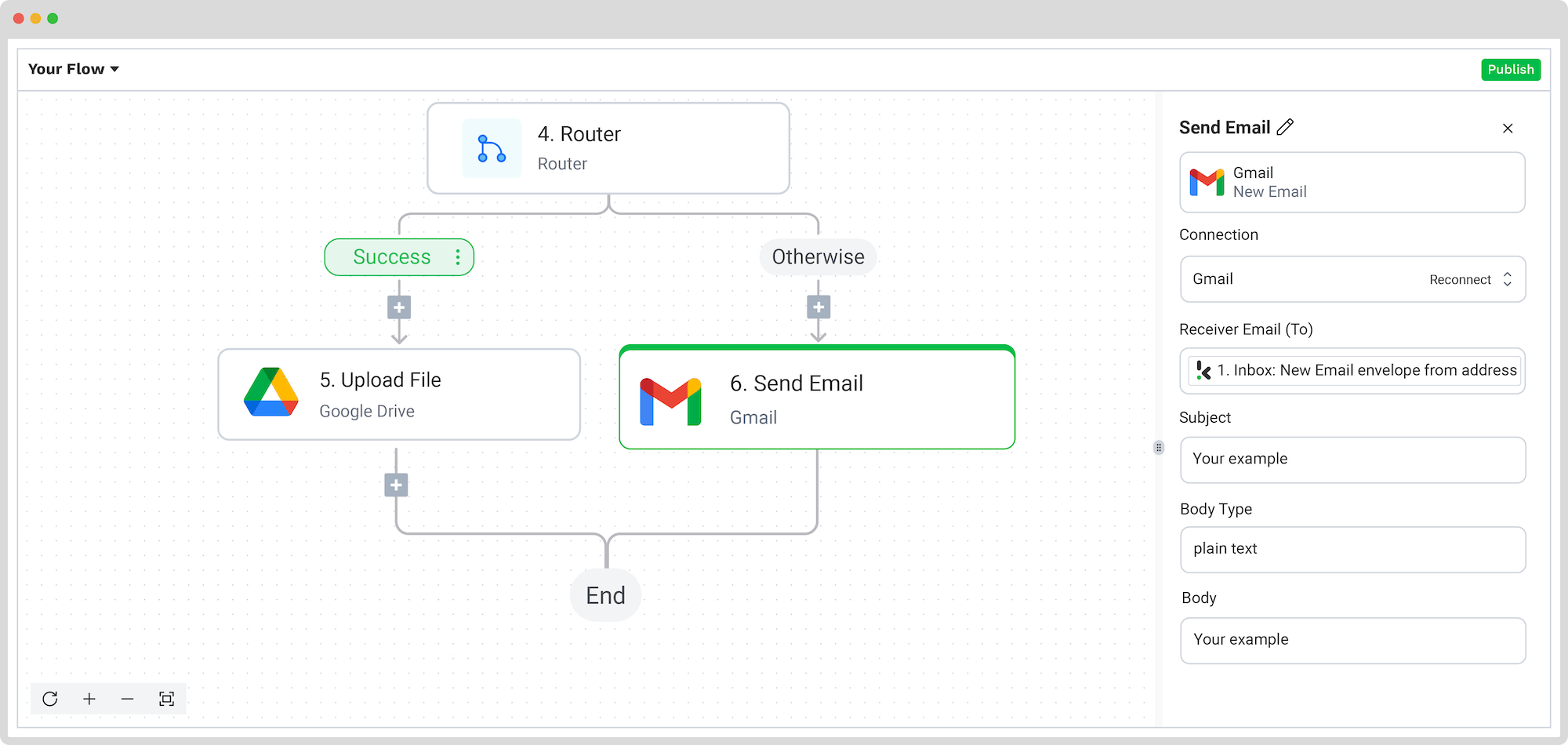

After all the data has been extracted, the next step will be to use the Router option; this defines what the platform should do when certain conditions we set are met or not. For our example, the condition will be whether the purchase order and the invoice match. The possible solutions will be Success and Otherwise. We’ll need to configure only the Success branch.

To do this, we are going to select Execute: Only the first (left) matching branch and set the rules by clicking on Branch 1:

- For the first value: 2. Document Capture: Financial Document -> components -> reference_details -> purchase_order_number

- For Text: (Text) Exactly Matches

- For the second value: 3. Document Capture: Financial Document -> components -> reference_details -> purchase_order_number

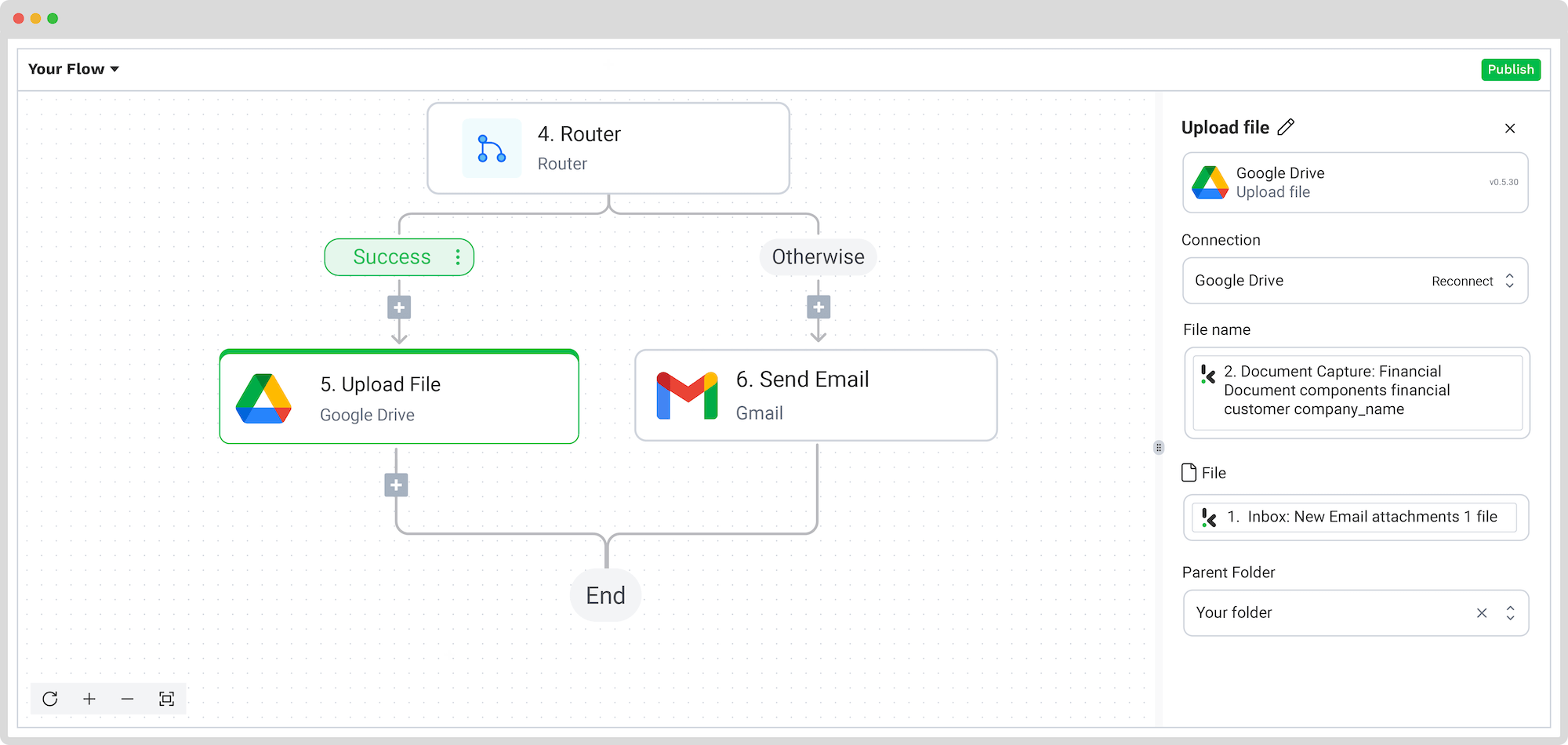

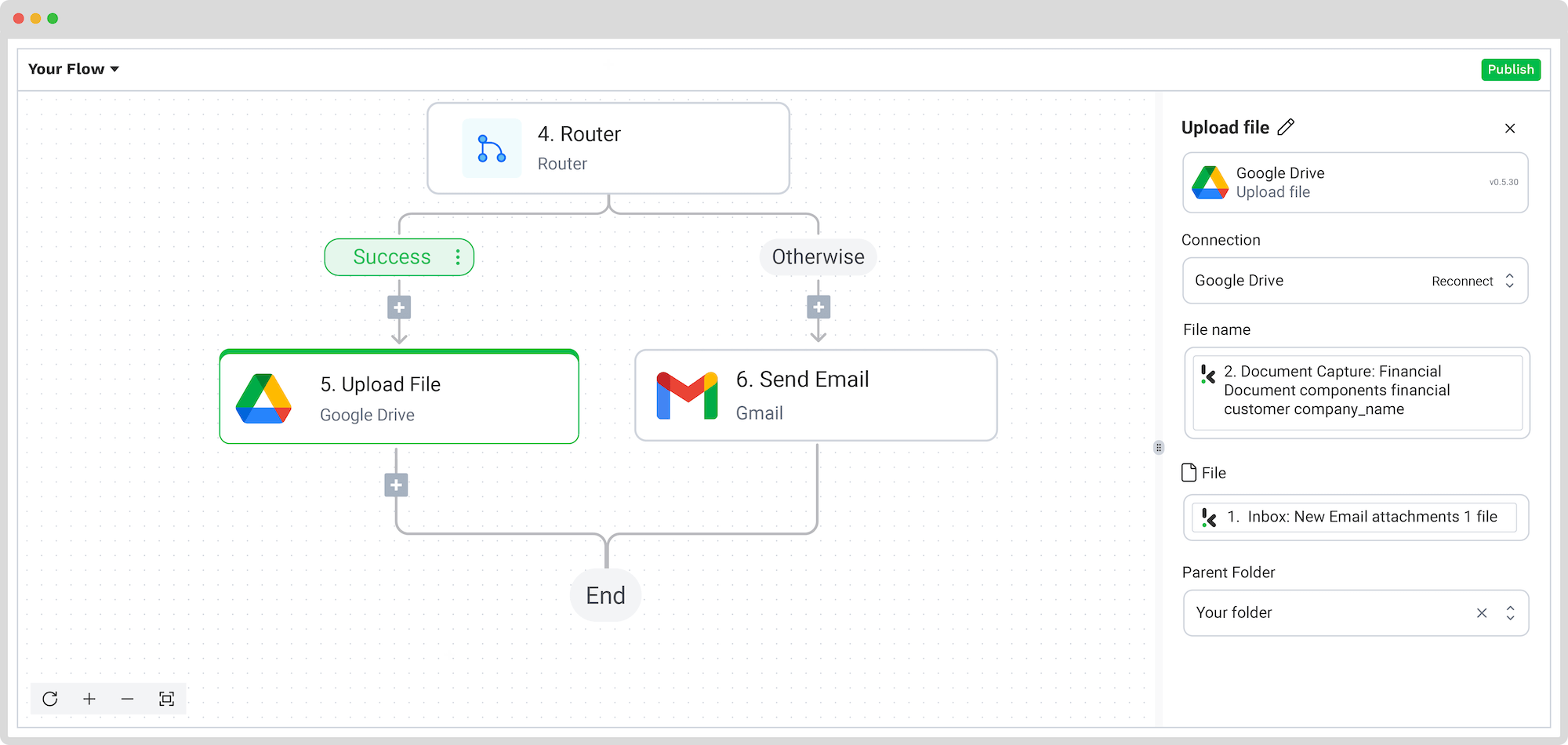

Step 6: Save the file if two-way matching succeeds

Now, we need to define what will happen if the condition before is met: what will happen if the purchase order and the invoice match. If they do, it’s only natural that we’d like these files to be uploaded to the designated folder.

In the Flow Builder, click the + button, search for Google Drive, and select Upload File. Also, connect this step to the Drive.

For the File name, you can pick any components that make sense. For example, we wanted to use the sender’s company name as the file’s name. We did this by clicking on Document Capture: Financial Document -> components -> financial -> customer -> company_name.

By default, all data extracted in the flow is automatically converted into JSON format, but you can convert it to another format, such as PDF, XLS, or CSV. Do this by placing the necessary extension in the File or URL section.

For File, it depends on which file you want to save. If you want both files to be uploaded, you should have 2 Google Drive: Upload file separate steps, and then have one file configured to each. Unfortunately, putting the two files in the same box won’t work.

Let’s assume this is file 1 you’d like to upload. In the File box, find in the menu 1. Inbox: New Email -> attachments 1 -> file. If you’d like to have file 2 also uploaded, create a new step below this one and find it in menu 1. Inbox: New Email -> attachments 2 -> file.

Step 7: Send an email if the two-way matching fails

The 6th step is to define what happens if the purchase order and the invoice don’t match. For this situation, you can choose what needs to happen. For example, you can decide to send an email back to the sender in which you explain that the purchase order and the invoice you received unfortunately don’t match, and there might be a mistake.

To do this, you need to go under the Otherwise branch and add Gmail -> Send Email as the next step of the flow. After, create a connection between your Gmail account and the DocHorizon platform.

For Receiver Email (To), choose from the Data Selector menu Inbox: New Email -> envelope -> from -> original. For Body text, please select plain text. The subject, the body, and other email sections are highly customizable, so it’s up to you to decide what you write.

And… Mission accomplished! You’ve just set up an automated two-way matching workflow that captures purchase orders and invoices, extracts key invoice data, cross-checks it against purchase order details, and uploads the matched files to the correct folder in Google Drive.

Before you sit back and let automation do the work, test the full flow with sample invoices and purchase orders. This ensures your matching logic runs smoothly and everything is synced just right.

And remember: if you’re processing a high volume of documents, you don’t have to set up the flow yourself! Feel free to reach out to us because we’d love to help you out!

Other Types of Invoice Matching

While two-way matching is the most straightforward form of invoice matching, it isn’t the only type of matching. Some companies choose the use of three-way or four-way invoice matching, which increases the level of complexity, but also the level of security and accuracy drastically.

Let’s have a quick look at how these methods work.

Three-Way Matching

For the most part, two-way and three-way matching follow the same process. The main difference is that three-way matching compares an invoice, a purchase order, and a receipt of the invoice. Only when all three documents match is the invoice approved and paid.

Four-Way Matching

With four-way matching, the complexity and therefore the security of the process really increases. First, the receiving department stores the data of the packing slip that comes with a purchase and ensures that all items are inspected for the correct quantities. Then, an inspection slip is issued by the department.

As the next step, the purchase order, packing slip, inspection slip, and invoice are matched against each other. Only if all information aligns is the invoice approved and paid.

Invoice Matching Terms

Purchase Order (PO): A document created by the buyer and sent to the supplier, detailing the required products or services, their quantities, and agreed-upon prices. It serves as the basis for the invoice-matching process.

Invoice: A formal request for payment issued by the supplier to the buyer for goods or services provided. It includes details such as item descriptions, quantities, prices, and payment terms.

Goods Received Note (GRN): A document confirming the receipt of goods or services by the buyer, used to verify that the received items match what was ordered.

Invoice Hold: A status applied to an invoice when there is a discrepancy between the invoice and other related documents, such as the PO or GRN, requiring further investigation before payment can be processed.

Tolerance: A predefined acceptable range of deviations between the invoice and other documents. If discrepancies fall within this range, the invoice can be processed without further review.

Touchless Processing: An automated invoice processing system where no manual intervention is required, from receipt and validation to approval.

Price Deviation: A mismatch between the price listed on the invoice and the price specified in the PO or other relevant documents, often resulting in an invoice hold.

Quantity Deviation: A mismatch between the quantity of goods or services listed on the invoice and what was ordered or received, which can also trigger an invoice hold.

Non-PO Matching: A validation process for transactions that do not involve a purchase order, such as recurring subscriptions or ad-hoc purchases.

Terms of Sale: The conditions specified on the invoice include total cost, payment due date, quantity and quality of goods, invoice number, delivery date, and accepted payment methods.

Understanding these terms is crucial for navigating the invoice-matching process efficiently and ensuring accurate and timely payments.

Common Challenges in Implementing Two-Way Matching

Implementing two-way matching in accounts payable can significantly improve financial accuracy and efficiency, but it comes with certain challenges. Below are some of the most common obstacles businesses face and practical solutions to address them.

1. Data Entry Errors & Inconsistencies

Challenge: Manual data entry often leads to discrepancies between invoices and purchase orders, such as incorrect pricing, missing details, or formatting inconsistencies. These errors can cause delays in payment processing and require additional verification efforts.

Solution:

- Standardize data formats: Ensure that suppliers adhere to a standardized invoice template that aligns with your internal purchase order format.

- Automate Data Entry: Use OCR and AI-powered document processing to extract key invoice details automatically and reduce manual input errors.

- Implement Validation Rules: Set up rules in your accounting system to flag discrepancies, such as incorrect tax amounts or duplicate invoices, for review before processing.

2. Missing or Incomplete Purchase Orders

Challenge: In some cases, purchase orders may be missing essential details, such as item descriptions or pricing, making it difficult to verify invoice accuracy.

Solution:

- Enforce a strict PO policy: Require all purchases to go through an approved purchase order process to ensure consistency.

- Integrate PO and Invoice Systems: Use procurement software that automatically links purchase orders with invoices, reducing manual tracking efforts.

- Enable Real-Time PO Creation: Allow departments to generate purchase orders digitally at the time of ordering to prevent incomplete documentation.

3. Discrepancies in Pricing or Quantities

Challenge: Invoices sometimes reflect different pricing or quantities than the original purchase order due to supplier errors, price fluctuations, or miscommunication.

Solution:

- Negotiate Clear Pricing Agreements: Establish contracts with fixed pricing or acceptable variance thresholds to minimize discrepancies.

- Implement Tolerance Levels: Configure your AP system to allow minor variances (e.g., ±2%) for automatic approval while flagging significant mismatches for manual review.

- Enable Automatic Price Verification: Use software that cross-checks invoice amounts against the agreed-upon contract or PO pricing in real-time.

4. Lack of Integration Between Systems

Challenge: Many businesses operate separate systems for procurement, accounting, and invoice processing, leading to inefficiencies and mismatched data.

Solution:

- Adopt an Integrated AP Solution: Use an accounts payable system that seamlessly connects with your ERP, procurement, and financial systems to ensure data consistency.

- Enable API-Based Synchronization: If full integration isn’t possible, use APIs to automate data exchange between different platforms.

- Automate Approval Workflows: Implement a workflow where invoices are automatically routed to the correct approver based on predefined criteria.

5. Delays in Approvals & Processing

Challenge: Slow approval processes, caused by manual workflows and reliance on paper-based approvals, can delay supplier payments and impact vendor relationships.

Solution:

- Use Digital Approval Workflows: Implement cloud-based approval systems where managers can approve invoices via email or a mobile app in real-time.

- Set Automated Escalations: If an invoice isn’t approved within a set timeframe, configure automatic reminders or escalate it to a senior approver.

- Define Approval Thresholds: Allow low-value invoices to be auto-approved while requiring additional verification for high-value transactions.

By proactively addressing these challenges with automation, integration, and process standardization, businesses can streamline their two-way matching processes. This helps reduce errors and ensures financial accuracy.

Industries that Benefit from Two-Way Matching

Two-way matching is a game-changer for industries that rely on smooth procurement and accurate invoicing. Here’s where it makes the biggest impact:

Retail & E-commerce

Retailers deal with a high volume of orders and vendors. Two-way matching helps verify that invoiced items were actually ordered, reducing overpayments and maintaining clean supplier relationships. It also gives finance teams better control over stock-related costs, especially during peak seasons.

Manufacturing

From raw materials to machine parts, manufacturers handle complex orders every day. Matching POs with invoices ensures accurate pricing and quantity checks, supports better planning, and reduces the risk of production delays caused by mismatched deliveries.

Wholesale & Distribution

Large B2B orders come with big stakes. Two-way matching helps avoid costly mistakes by flagging discrepancies before they cause delays in payment or delivery. It ensures operational efficiency even when managing hundreds of supplier relationships at once.

Logistics & Transportation

Whether it’s freight services, fuel, or cargo handling, two-way matching keeps costs under control by confirming that invoiced services align with the original order. By comparing documents like airway bills, manifests, and delivery notes, logistics teams can flag mismatches early. This is essential for companies handling subcontractors, international routes, and complex customs processes such as clearance.

Healthcare

Hospitals and clinics rely on steady supplies of equipment and medicine. Two-way matching helps verify every line item, keeping procurement transparent and compliant. In regulated environments, this also supports audit readiness and strengthens internal controls.

Professional Services

Agencies, law firms, and consultancies often work with external vendors. Two-way matching protects against billing errors and ensures you only pay for what was approved. It adds an extra layer of control when outsourcing services, tools, or licenses across teams.

Automate Two-Way Matching With Software by Klippa

Above, we mentioned a few things that could go wrong in a manual invoice-matching process. With OCR-based software such as Klippa DocHorizon, these challenges are history. DocHorizon can help you automate two-way matching from the very first step (data entry) of invoice matching.

Data entry from POs, invoices, and other documents is a crucial step in the matching process, as the entire process is based on this information. As our software can automatically enter data into your accounting system, human errors resulting from manual data entry are prevented.

In general, Klippa’s software can read and extract relevant data from invoices, purchase orders, and other documents with the help of OCR. This means that the variety of documents involved in the matching process can reliably be captured, and information stored in your database.

Since all documents are now converted from physical to digital format, the software can compare and match them automatically. This is possible because of the conditions specified before the matching process. These conditions, determined by you, tell the software which information to pay attention to on a document. This is what two-way matching looks like when it’s automated.

Additionally, our software can automatically recognize fraudulent and duplicate financial documents, helping you to always pay the right amounts.

Do you want to know more about Klippa and how DocHorizon can automate your invoice-matching process? Please book a free demo below or contact one of our experts!

FAQ

Two-way matching is an invoice verification process where the details on an invoice are compared with a corresponding purchase order (PO) to ensure accuracy before payment is made. This helps prevent fraud, overpayments, and accounting discrepancies.

The process involves:

– Matching the invoice amount, items, and quantities to the approved purchase order.

– Identifying any discrepancies between the invoice and PO.

– Approving or flagging the invoice for further review before payment is processed.

– Two-way matching: Compares the invoice with the purchase order.

– Three-way matching: Adds a goods receipt note (GRN) to verify that the goods or services were received.

– Four-way matching: Includes a quality check to ensure the received goods meet agreed specifications.

Two-way matching helps businesses:

– Prevent fraudulent invoices and overpayments.

– Ensure payments match agreed purchase terms.

– Streamline audits and ensure compliance with financial regulations.

Businesses may face:

– Data entry errors causing discrepancies.

– Incomplete purchase orders delaying approvals.

– Price or quantity mismatches due to supplier errors.

– Integration issues with ERP or accounting software.

Yes. Automated invoice matching software can:

– Extract invoice data using OCR (Optical Character Recognition).

– Automatically compare invoice details with purchase orders.

– Flag mismatches for manual review.

– Speed up approvals and integrate with accounting systems.

Two-way and three-way matching are most commonly used to verify that what was ordered, delivered, and invoiced all match, helping prevent errors and overpayments.

In logistics, this means comparing documents like airway bills, delivery notes, and manifests to catch discrepancies before they delay cargo processing.

In procurement-heavy industries like retail, manufacturing, and distribution, it’s used to confirm that invoice amounts and quantities align with purchase orders and receipts. This ensures smoother operations, better cost control, and fewer manual checks.