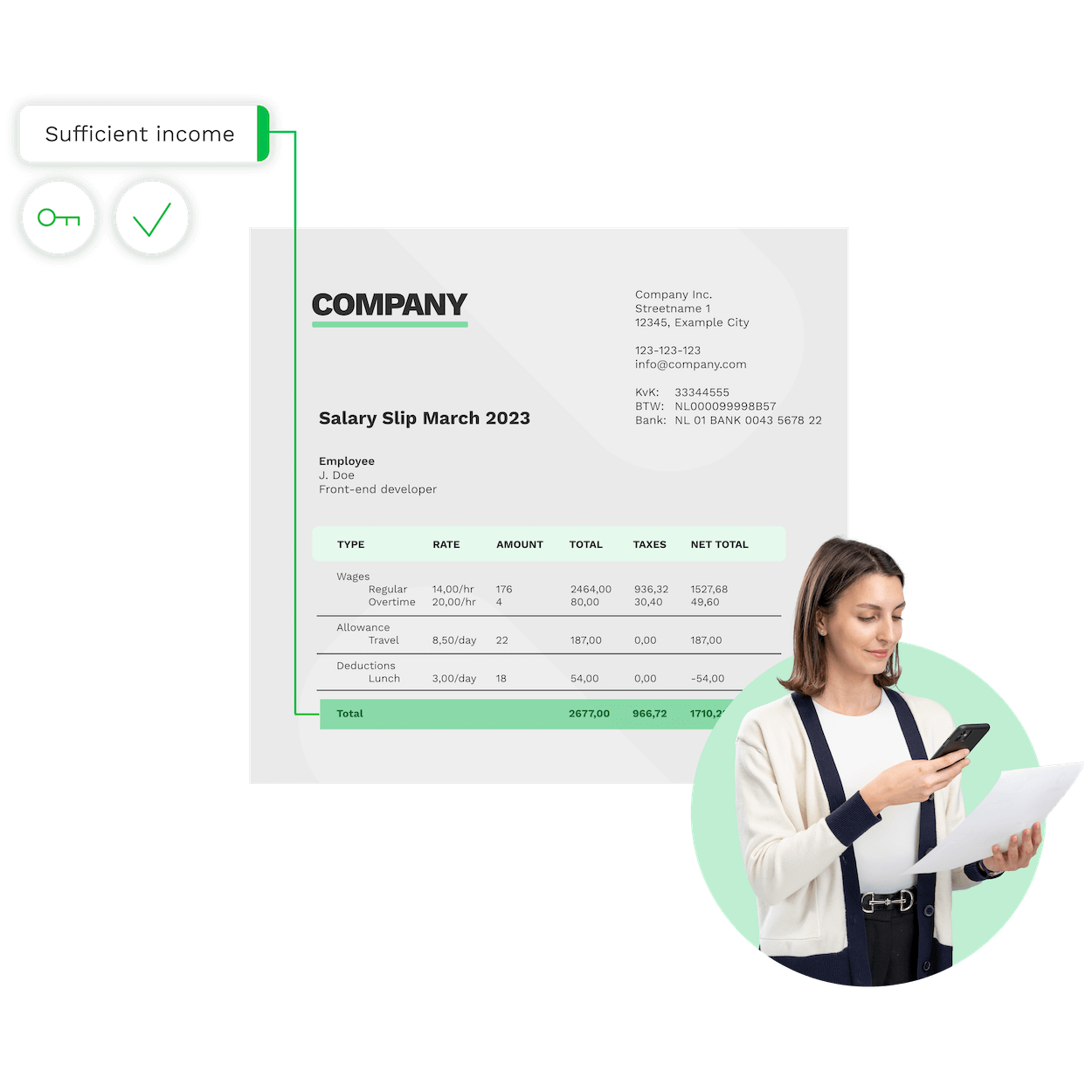

Affordability Checks Powered by AI

Real-time affordability checks with AI-powered software. Automatically verify bank statements or payslips for faster affordability screening.

Trusted by 1000+ brands worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

Automate Your Affordability Checks

Effortlessly detect fraud from documents you need during your affordability checks using automation and AI. Our solution makes understanding your clients’ financial situations quicker and easier than ever, all while maintaining regulatory compliance.

Benefits for Your Business

DocHorizon automates affordability checks streamlining your onboarding process, and getting rid of tedious checks.

Benefits for Your Clients

DocHorizon enhances both your experience and your users’ with faster, transparent, and secure processes.

Secure Affordability Checks for Your Use Case

Documents We Support for Your Affordability Checks

Process various document types for your affordability checks such as financial documents, and identity documents. Our advanced OCR technology extracts data quickly and accurately for you.

How it works

Perform affordability checks in seconds.

Upload your documents

Upload any file from email attachments (such as bank statements or salary slips) to scanned documents and our software handles the rest.

Supported formats include:

.jpg, .jpeg, .png, .pdf, .doc, .docx, .xlsx, .heic, .webp, and more.Data Extraction

Our advanced AI-powered OCR analyzes and automates data extraction from documents without relying on templates.

Document verification with checks

After data extraction, our solution validates the information, performs customized checks, and flags any missing or potentially fraudulent data.

Export structured data

You can forward structured data to your CRM, ERP or database directly – or export the data as

.json, .csv, .xml, .xls, .ubl, and more.- ✓ Secure

<img class=”lazy lazy-hidden” decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/06/Security_Logos_Box.jpg” data-lazy-type=”image” data-src=”https://www.klippa.com/wp-content/uploads/2024/06/Security_Logos_Box.jpg” style=”display: inline; max-width: 100%; border-top-left-radius: 10px; border-top-right-radius: 10px; border-bottom-left-radius: 10px; border-bottom-right-radius: 10px; “/> - ✓ Compliant

<img class=”lazy lazy-hidden” decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/06/security-compliance-data.jpg” data-lazy-type=”image” data-src=”https://www.klippa.com/wp-content/uploads/2024/06/security-compliance-data.jpg” style=”display: inline; max-width: 100%; “/> - ✓ Protected

- ✓ Hosted in EU/US

- ✓ Trusted

Why Businesses Choose Klippa For Affordability Checks

- Batch processingUpload multiple documents at once, ensuring scalable, efficient, and accurate data extraction.

- Ensured data protectionBy default, we do not store any data that is being processed on our servers to ensure regulatory compliance.

- Wide document supportOur solution supports various document in 150+ languages ensuring versatility and flexibility.

- Seamless integrationWith a comprehensive documentation you can implement DocHorizon via API or SDK within 24 hours.

“It is extremely pleasant to work together with a party that is as ambitious as we are. The willingness and speed with which Klippa implemented specific modifications for us is impressive.”

Frequently Asked Questions

How does Klippa verify document authenticity & validity with checks?

How does Klippa verify documents’ authenticity & validity with checks?

Klippa combines multiple technologies to verify the authenticity and validity of documents by analyzing their content. We use OCR, data parsing, machine learning, and computer vision technology developed in-house to conduct thorough document checks.

Additionally, Klippa’s solution leverages AI to analyze the pixel-level structure of documents in the metadata to detect fraud. Additionally, it performs third-party verification checks to ensure the documents’ validity.

On what platforms does document checking work?

On what platforms does document checking work?

Klippa provides its document checking services via an Intelligent Document Processing Platform, API and SDK.

This means our software can be implemented into any existing workflow (web & mobile applications). With the API integration, you would only need an internet connection.

What types of checks can Klippa perform?

What types of checks can Klippa perform?

Klippa DocHorizon can be used to perform ID checks, insurance checks, resume checks, right to work checks, income checks, age checks, and many more thanks to our AI models.

If you have a specific question about your use case, feel free to contact us.

What document types can Klippa perform the checks on?

What document types can Klippa perform checks on?

On every document type, image, PDF or other file format, various checks can be done. Additionally, we support over 150 languages with our current AI-powered document checking solutions.

Contact us to find out if we can support your use case. In most cases this will be possible, but it might require training data.

What about data privacy and security measures?

Data privacy and security are very important to us.

By default, Klippa does not store any customer data on its servers. Data is always processed under a data processing agreement (DPA) and all services from Klippa are compliant with GDPR.

All data transfer is done via secure SSL connections. Our servers are ISO-certified and by default located in Amsterdam, the Netherlands. Getting a custom server on a location of choice is possible in any location worldwide.

On a regular base, our security is tested via third-party penetration testing to ensure state-of-the-art security at all times.

You can find all information you need on our compliance page.